On August 16th, Colorado approved a rule requiring automobile manufacturers to have a certain percentage of their sales come from electric vehicles between 2023 and 2030. This type of rule, also known as a Zero Emission Vehicle (ZEV) mandate, forces the adoption of vehicles that have been slowly gaining market share. Currently, electric vehicle sales represent about 2 percent of all new vehicles sold in the United States, up from about 1 percent in 2016. Colorado, like 10 other ZEV states, wants to hasten the growth in EV sales. The mandate is part of a broader regulation called Colorado Low Emission Automobile Regulation (“CLEAR”), which was developed to address air quality concerns in the state.

Colorado’s ZEV program requires a gradual increase in battery electric vehicles (EVs) and plug-in hybrid vehicles (PHEVs) starting in 2023. The program requires an initial increase in ZEV sales from 2023 to 2025 then a leveling off at 6.07 percent through 2030. In March 2019, about 3.5 percent of Colorado new vehicle sales were ZEVs, up from about 1.5 percent in 2017. The 2025 requirement would require nearly double the ZEV sales relative to today, making the program seemingly daunting at first thought.

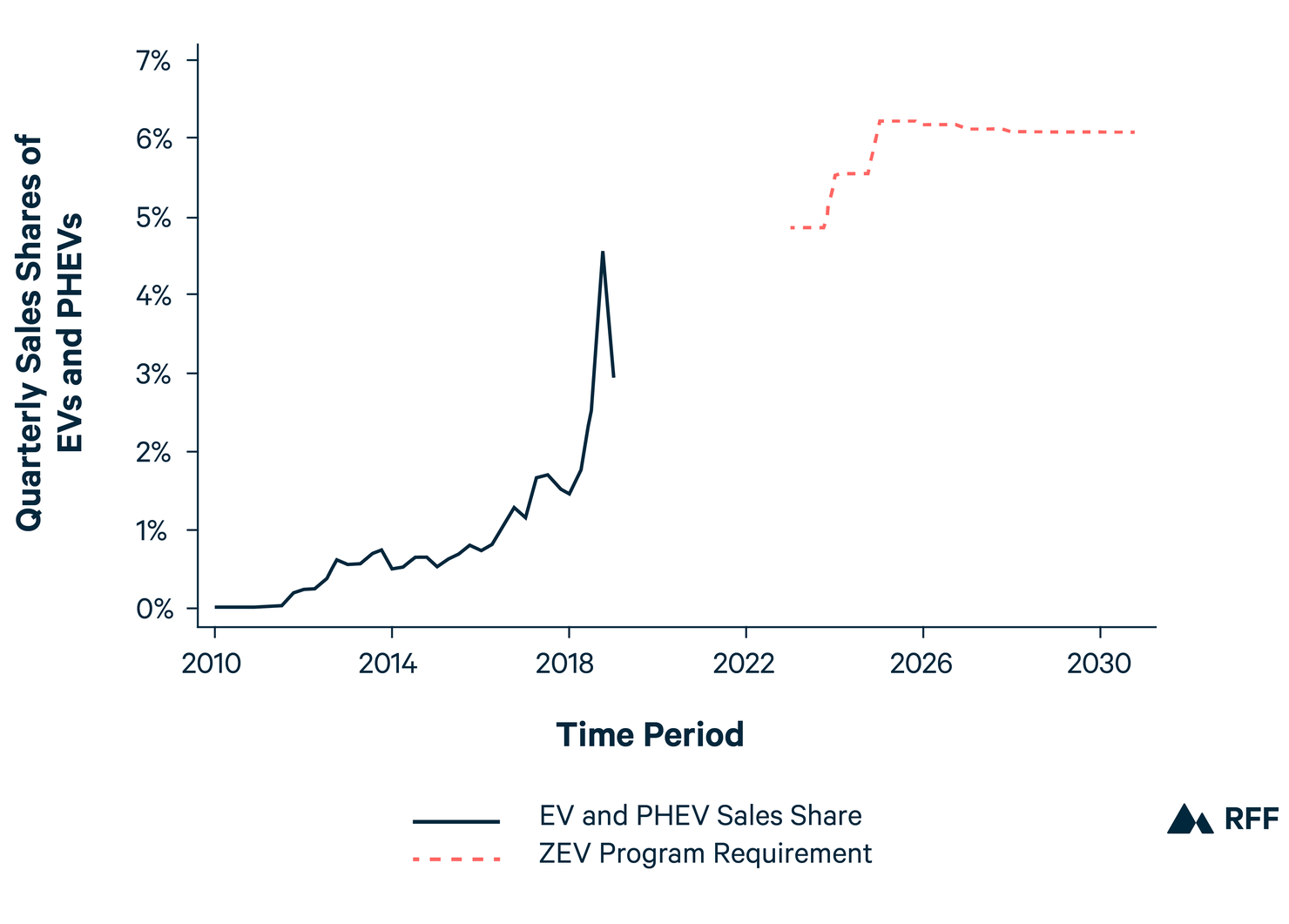

Will automakers achieve the new Colorado requirements? To get a sense of the stringency of the program, we plot quarterly sales shares of EVs and PHEVs in Colorado—measured as new EV and PHEV sales divided by total new vehicle sales in Colorado—from 2010-2018 along with the ZEV program requirements in Figure 1:

Figure 1. Colorado EV and PHEV Sales and ZEV Program Requirements, 2010-2030

Sources: IHS Automotive Sales Data and Initial Economic Impact Analysis 2019, Revisions to AQCC Regulation Number 20: Zero Emission Vehicle Program

Figure 1 clearly shows that EVs and PHEVs have seen incredible sales growth during the last few years. Eyeballing the growth based on the figure would lead to the conclusion that the program’s requirements will be met if the popularity of ZEVs continues to rise at the same rate.

A few factors will play a key role in determining this future growth. First, the gradual phase-out of federal and state subsidies for ZEVs may dramatically reduce their demand. The $7,500 federal subsidy for EVs has already started to phase out for Tesla vehicles. While Colorado currently provides a tax credit of $5,000 for ZEV buyers, this credit is scheduled to fall to $2,500 by 2025 and may be removed completely after that year. These changes will effectively raise purchase prices of ZEVs. Recent research suggests that ZEV buyers are quite sensitive to price incentives. As a result, the removal of the incentives could significantly reduce ZEV demand, making the requirements more challenging to meet. On the other hand, future falling battery prices could very well counteract this effect as automakers would be able to pass on cost reductions in the form of lower sticker prices.

Second, charging station infrastructure is expected to continue growing rapidly over time. Colorado has committed to expanding its charging station infrastructure throughout the state, focusing on expanding its network of fast charging station networks. One detail of this commitment is to use the $10.4 million awarded from the Volkswagen settlement for light-duty electric vehicle charging stations. This commitment will gradually reduce range anxiety (a fear of running low on power without a charging station nearby) among potential ZEV buyers, boosting demand.

Third, automakers are gearing up to release many new ZEV models during the next five years, which will undoubtedly expand ZEV demand. The large jump in Colorado ZEV sales in 2018 was almost exclusively due to the introduction of the Tesla Model 3. Currently, the set of ZEVs available to consumers does not include popular segments of the new vehicle market, including affordable crossover utility vehicles (CUVs), sport utility vehicles, (SUVs), and pick-up trucks. These segments represent nearly two-thirds of the new vehicle market. Tesla is planning to sell its “affordable” Model Y SUV in 2021 and Ford has announced that is planning to build a fully electric F150 pickup. These two vehicles could sufficiently bolster demand to help automakers achieve Colorado’s ZEV program requirements.

Taken together, these factors suggest that Colorado’s new program should be attainable. Moreover, with the program in place, automakers have an additional incentive to reduce costs of their current ZEVs and introduce more mainstream ZEVs to the marketplace. With Colorado joining 10 other ZEV states, about one-third of all vehicles sold in the US fall under one of the ZEV requirements. This growing share is providing a clearer signal to automakers to transition their fleets to electric.