Batteries in electric trucks can be prohibitively expensive, with the cost passed along to consumers. But can we point to other reasons that electric trucks continue to cost far more than their diesel counterparts?

Electric trucks are an emerging and technologically viable solution for decarbonizing the shipping sector and reducing local air pollution, as they have zero tailpipe emissions and, for many use cases, have sufficient battery range for necessary fleet operations. Yet, some electric trucks—particularly the larger vehicles—are much more expensive than their diesel counterparts. Due to these price discrepancies, the Inflation Reduction Act provides up to $40,000 in incentives for fleets to adopt them. Unfortunately, for many of the trucks on the market, this amount may not be enough to even cover the price difference between an electric and diesel truck.

It’s important for us to understand why these large electric vehicles are so much more expensive than their diesel counterparts. (Keep in mind that, for passenger cars, the difference between electric and gasoline options can be $10,000 or less, depending on the vehicle.) Part of the price gap for trucks likely has to do with the cost of the battery. In this blog post, I explore some additional reasons and try to understand which factors affect the price difference between diesel and electric trucks.

Understanding what accounts for the high price of electric trucks matters because appropriate policy solutions will depend on what factors affect prices the most. Different policy solutions will work in different ways to bring vehicle prices down and help spur greater adoption of electric vehicles. For example, if battery costs define the price differential between electric and diesel trucks, then targeted subsidies for battery research and development could help bring down that price differential. On the other hand, if market power keeps the prices high, then an entirely different set of policies will be needed.

Along with colleagues, I present some of these policy options in a newly released report about electrifying medium- and heavy-duty vehicles, in which we explore the challenges associated with the adoption of electric trucks and discuss policy solutions that can help achieve a transition to electric vehicles in a cost-effective and equitable manner.

Large Batteries Increase the Cost of Trucks

To explore why these vehicles are so expensive, we can start with the cost of the battery. Trucks and buses, particularly when they’re heavy duty, will require batteries that are much larger than those found in passenger vehicles. For example, compare the Tesla Model Y, a passenger car with a 74-kilowatt-hour battery, to the Tesla Semi, which has a battery that’s over ten times larger and the longest range of any heavy-duty vehicle on the market. Battery costs scale with size: The bigger the battery, the more expensive the vehicle.

Market Factors Can Affect Costs, Too

Other market-based reasons can explain why electric trucks are so much more expensive than diesel trucks. In our report on electrifying medium- and heavy-duty trucks, we conducted literature reviews and interviewed manufacturers and experts in the field to better understand the underlying challenges associated with electrifying these vehicles.

One of the things we learned during this process is that a lot of start-up costs are associated with building electric trucks. Each time a manufacturer wants to build a new type of vehicle, they also have to invest in all the necessary tools and processes to make the vehicle. And each time the battery technology changes (which happens frequently), manufacturers need to adjust their approach, which costs them millions of dollars. Permitting costs also are required to build new manufacturing plants or to convert existing plants to electric vehicle manufacturing.

These high up-front costs have two effects. First, these costs deter the entry of new manufacturers. Second, these costs incentivize manufacturers to limit the number of vehicle product offerings, given that each new vehicle type carries its own start-up costs. As a result, prohibitive start-up costs keep the number of active manufacturers down, while also limiting diversification within a company.

These dynamics can result in market concentration and limited competition among manufacturers. Paired with low demand, this scenario can lead to prices staying high in the short to medium term, as manufacturers are able to pass these costs through to the customer more readily than in a case of high competition in the market. In the case of higher competition, manufacturers would be less able to pass these fixed costs on to customers, which would result in lower prices.

Comparing the Battery Cost to the Price Difference between Electric and Diesel Trucks

Let’s explore for a moment the role of battery costs in defining the price differential between electric and diesel trucks. On first thought, one would expect that the battery cost would define the price differential; the manufacturer has to pay for the battery, so we may expect the manufacturer to increase the cost of the vehicle by the amount of the battery cost—yet this guess isn’t exactly correct. Engineers have demonstrated that, apart from the cost of the battery, the total cost of the other parts that comprise an electric truck may be lower than for diesel trucks (Figure 1), given that electric trucks don’t include a transmission nor other fuel-related vehicle parts.

Figure 1. Vehicle Manufacturer’s Suggested Retail Price, Broken Down by Cost Input

Modified figure from the National Renewable Energy Laboratory. “CNG” = compressed natural gas, “EV” = electric vehicle, “FCEV” = fuel cell electric vehicle, “HEV” = hybrid electric vehicle, “PHEV” = plug-in hybrid electric vehicle

The price difference between electric and diesel trucks thus depends on the following three factors: the battery cost; the difference in cost of the other parts of the vehicle (Figure 1); and the markup passed through to the customer that includes start-up costs and depends on market power and market concentration.

The one thing among these three factors that we can most easily calculate is the battery cost. If we observe the price differential to be less than or equal to the battery cost, we can infer either that the manufacturer has applied very little markup and/or that the manufacturer has derived significant savings on the vehicle cost in terms of non-battery parts.

For example, Figure 1 shows that in 2018, the price differential between the electric and diesel models of trucks was less than the battery cost, due to large savings from non-battery parts. However, because the figure is based on engineering estimates, it does not incorporate the potential for market power, market concentration, and economies of scale to increase the sales price. Alternatively, if the price differential far exceeds the battery cost, then significant markups may be due to market concentration, lack of competition, and low economies of scale (unless the engineering estimates are not correct).

Using Data to Calculate Markup

I wanted to know in more detail the degree to which market power leads to higher prices. To find out, I leveraged a data set on truck prices published by Price Digests. This data set, formerly known as the “Truck Blue Book,” reports characteristics of different trucks at the trim level, such as weight, horsepower, manufacturer, size class, price, fuel type, model year, battery size (if electric), and more. These data allowed me to look at three different types of commercial trucks: light duty, medium duty and heavy duty. The light-duty trucks included vehicle types such as a cargo van, a cutaway van, and a cab and chassis, so these are distinct from a traditional passenger vehicle truck.

With these data, I could compare the prices across electric and diesel options within the light-, medium-, and heavy-duty categories, while controlling for all other characteristics of a vehicle, such as horsepower, weight, size class, wheelbase, and more. For those interested in the technical specification of my approach, using data for model years 2021–2023, I regressed the manufacturer’s suggested retail price against a variety of vehicle characteristics and included interactions between the electric indicator and two separate indicators for light-duty and medium-duty vehicle categories. The coefficient on the electric indicator provided the markup for the heavy-duty classification, which allowed me to effectively compare the prices of two trucks that differed only in terms of their fuel type.

Next, I calculated the cost of the battery according to the average battery size for the vehicle type (light, medium, or heavy duty) and assumptions about battery costs. We can’t be certain of the price that a manufacturer paid for a battery, but average EV battery costs worldwide in 2021 were $118 per kilowatt-hour, though in the United States, the prices were higher at $157 per kilowatt-hour. I used both of these prices to calculate the battery cost, then compared these battery costs to the price differential.

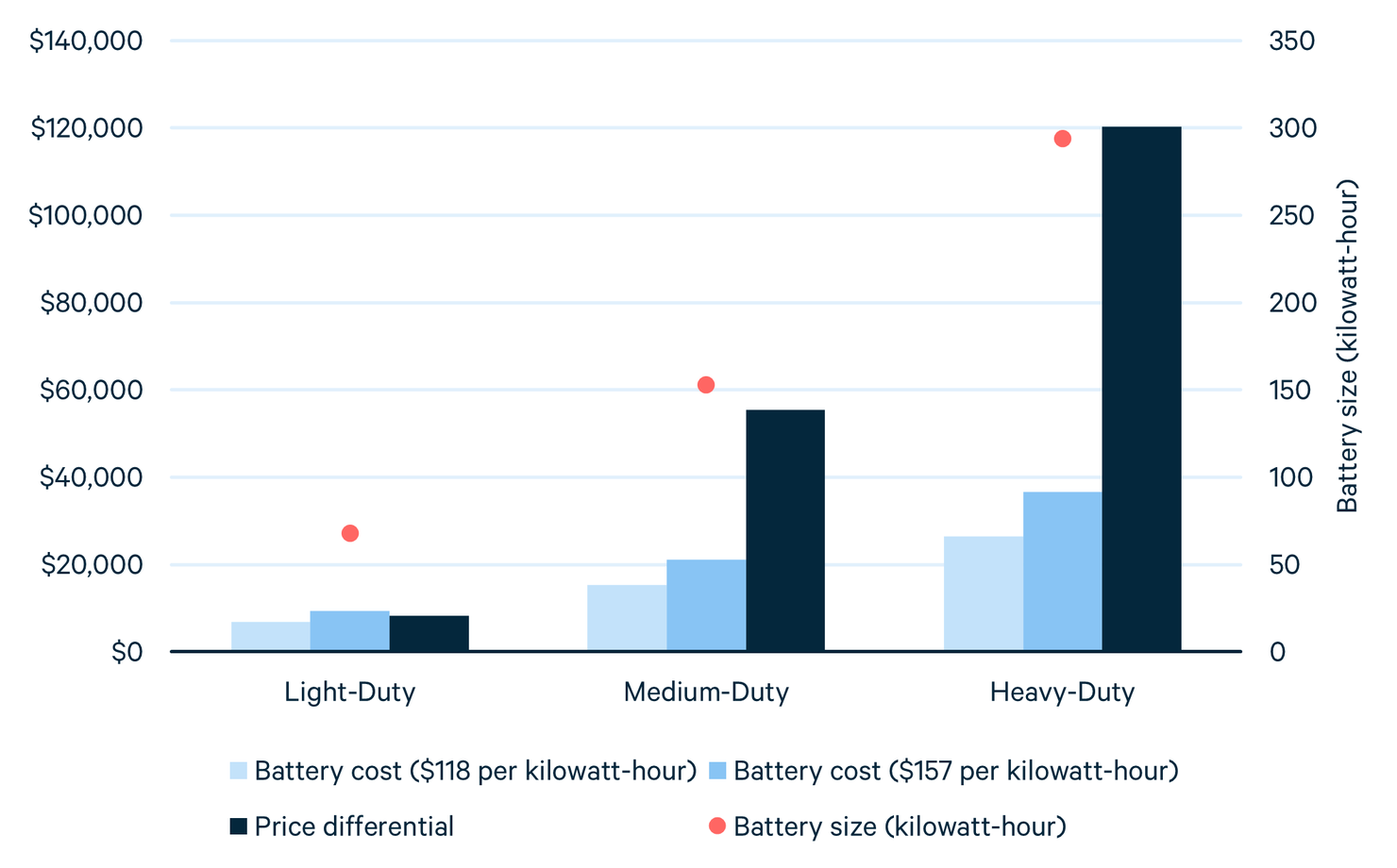

The results of this exercise are presented in Figure 2, which details the average battery size; battery cost under the two different assumptions for the price per kilowatt-hour; and estimated differential price between the electric and diesel options for each of the three vehicle types, given the results from my price analysis.

Figure 2. Price Differential and Battery Cost across Vehicle Type

Note: Coefficient results for each vehicle class have p value < 0.001; regression R2 = 0.93; number of observations = 16,256

The smaller vehicles, which contain battery sizes that are similar to those in long-range passenger electric vehicles, have a price differential that’s very similar to (and perhaps even less than) the battery cost. However, as the vehicle type gets larger, the battery gets larger, and the price differential rapidly exceeds the cost of the battery. In the largest vehicle category, the price differential is around three times the cost of the battery.

These results may be explained in two different ways. First, compared to the light-duty sector, the heavy-duty truck sector may have fewer opportunities to save costs through the non-battery parts of the truck. Second, the light-duty truck sector may be far more competitive than the heavy-duty truck sector. Part of this difference in competition may be due to greater demand for these vehicles, which makes it easier for manufacturers to enter the market. Smaller trucks are easier for fleets to adopt, logistically: smaller trucks generally have lower daily vehicle miles traveled, tend to be housed in depots and owned by larger fleets, and are cheaper, all of which makes adoption more financially attractive.

For large trucks, however, low economies of scale and limited competition appear to have kept prices high. High prices are problematic if we want to achieve widespread electrification of the medium- and heavy-duty vehicle sector, because larger trucks already are the hardest to electrify: most long-haul trucks are owned by small fleets, which have more limited credit capacity, and large trucks often are not housed in depots. Given the scarcity of public charging stations, the fleet logistics of electrifying large trucks becomes increasingly challenging in the short run.

Policy solutions exist, and many will need to be implemented to achieve the widespread adoption of these large trucks. Unfortunately, no silver bullet exists for overcoming the current hurdle of higher costs for electric trucks over diesel alternatives. Learn more about some possible policy solutions and the open questions that remain by reading our new report.