The Inflation Reduction Act (IRA) offers tax credits to clean-energy projects that are sited within an “energy community.” But how does the IRA define energy communities? And are these communities indeed most vulnerable in the transition to clean energy?

The Inflation Reduction Act of 2022 (IRA) aims to transform the energy system of the United States through a variety of incentives that encourage the deployment of clean energy technologies across the electricity, transportation, and buildings sectors. One of the hallmarks of the law is that, unlike most previous federal energy legislation, it ties many incentives to labor requirements, domestic manufacturing, and location of a project.

In this blog post, we’ll dig deep into that last element: location. Specifically, we’ll try to unpack what it means to be an “energy community,” point to some of the oddities of the IRA’s definition of those communities, and discuss whether the IRA effectively targets energy-producing communities that may be most hard hit by changes in the energy landscape.

The IRA offers clean-energy projects up to 10 percent additional financial incentives if the projects are sited within an “energy community.” But what actually is an energy community? Three types of geographies can be considered energy communities under the IRA, each with its own qualifying criteria. Two of the definitions are pretty straightforward, while the third is more complex and even a little odd.

Brownfields

Brownfields typically are small parcels of pollution-contaminated land that, once designated by the US Environmental Protection Agency, become eligible for funding that supports cleanup and redevelopment. Because of their modest size, these locations may be attractive to developers of utility- or community-scale solar, energy storage, and even manufacturing facilities. The Environmental Protection Agency has provided technical assistance to encourage solar development on brownfields and other contaminated sites for years.

Not all brownfields, however, have relevance to energy development. For example, around 15 brownfield sites have been identified in Ann Arbor, Michigan (where Daniel lives), which could hardly be considered an “energy community,” as the city has virtually no history of large-scale energy development.

Brownfields are distributed across the United States, with highest concentrations in the industrial Midwest and in the densely populated parts of the Northeast (Figure 1). Although more than 25,000 of these sites are scattered across the country, they cover just a small fraction of total US land area.

Figure 1. Brownfield Site Locations in the United States

Data source: US Environmental Protection Agency.

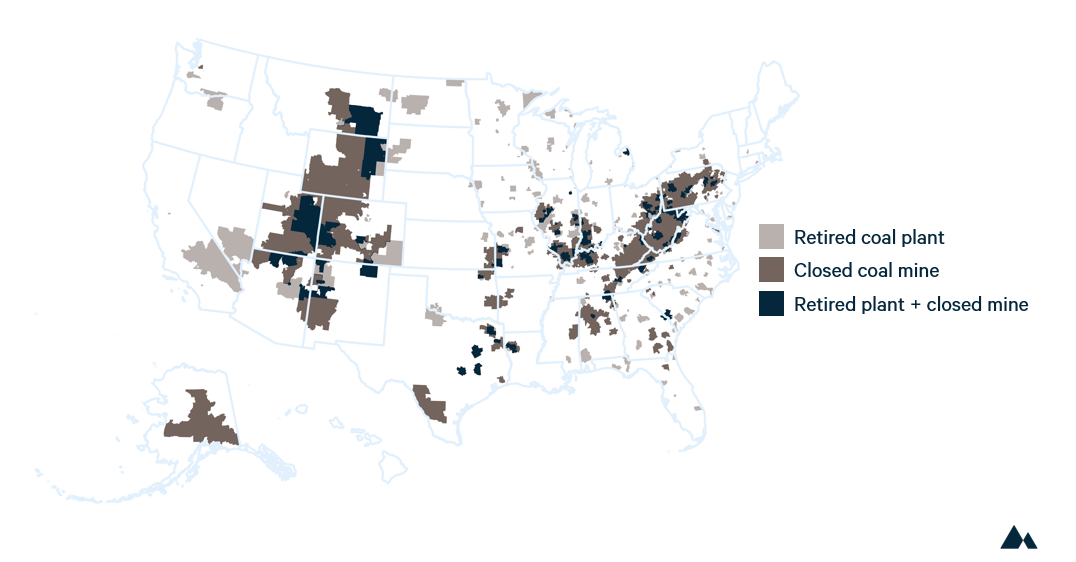

Coal Communities

Coal communities probably are the most clearly targeted of the three types of geographies defined by the IRA. Any census tract where a coal-fired power plant has closed since 2010, or a coal mine has closed since 2000, qualifies for additional incentives in the IRA, along with any adjacent tracts. As readers of this blog likely know, hundreds of coal plants and mines have shuttered in the past 20 years, and the IRA likely will accelerate the pace of future coal retirements.

The benefit of designating entire census tracts as energy communities is that developers will have more flexibility in siting their facilities and could build larger-footprint infrastructure such as utility-scale wind farms. But a potential downside of this extensive geographic scope is that projects may be developed tens, or even hundreds, of miles away from affected coal communities. For example, because census tracts in rural communities can cover hundreds of square miles, a wind project developed in the southeastern California desert may do little to support a community hundreds of miles away, where a coal plant may have closed down years earlier.

In total, these coal-plant and coal-mine provisions cover about 20 percent of the total US land area. Figure 2 maps out the census tracts that are eligible, with light gray indicating retired plants, darker gray indicating closed mines, and dark blue where both apply.

Figure 2. Coal Plants Retired from 2010 to 2021 and Coal Mines Closed from 2000 to 2022

Data sources: US Energy Information Administration, Form EIA-860 surveys. US Mine Safety and Health Administration, Data Set 13: “Mines Data Set.”

Jobs and Tax Revenue

The third, and most expansive, definition of an energy community is where things start to get kind of weird. The IRA defines this third type of energy community as a metropolitan or non-metropolitan statistical area (as defined by the Office of Management and Budget) where “0.17 percent or greater direct employment or at least 25 percent of local tax revenues [are] related to extraction, processing, transport, or storage of coal, oil, or natural gas,” and unemployment is at or above the national average in the previous year.

Here’s why that definition is a little odd. First, because unemployment rates change frequently, it’s not quite clear whether an energy community will stay an energy community—and continue to be eligible for the bonus tax credit—if its unemployment rate falls below the national average. Presumably, the Departments of Energy and the Treasury will need to answer this question and find a workable solution.

The second surprising detail about this definition is the relatively low employment rate necessary for an area to be eligible. The sectors mentioned in the law (which we classify in Table 1) collectively employed about 0.59 percent of the US workforce in 2020. These data indicate that many “energy communities” will have substantially less energy-related employment than the US average, which would be odd indeed.

Table 1. North American Industry Classification System (NAICS) Codes Included for Fossil Fuel Employment and Tax Revenue

Importantly, statistical areas can be really, really large. For example, most of Alaska, Montana, Nebraska, Nevada, and large swaths of other states belong to a single non-metropolitan statistical area. As a result, the areas covered by the IRA as energy communities represent a whopping 82 percent of total US land area. With the provision that qualifying areas must have higher-than-average unemployment (we use as a baseline the US average in 2021, 5.3 percent), the number of eligible regions shrinks considerably—but the collective area still accounts for 39 percent of US land.

In addition, the qualifying regions don’t map neatly onto locations where we would consider many energy communities to occur: although they cover many oil-, gas-, and coal-dependent communities in Texas, New Mexico, West Virginia, and Pennsylvania, the qualifying regions omit all or most of North Dakota, Wyoming, and Oklahoma, where fossil fuel production plays a key role in local economies. What’s more, regions with little or no fossil fuel production, such as large swaths of Michigan, Oregon, and Washington State, are included. Figure 3 illustrates these results, with light pink indicating areas with at least 0.17 percent fossil fuel employment but lower-than-average unemployment, and dark pink indicating eligible areas.

Figure 3. Statistical Areas with at Least 0.17 Percent of Employment from Fossil Fuels

Data sources: US Census County Business Patterns for employment; US Bureau of Labor Statistics for statistical area definitions. Includes areas with at least 0.17 percent of employment from fossil fuels at any time from 2010 to 2020 and unemployment greater than 5.3 percent in 2021.

OK—here’s where it gets really weird. An energy community also may be one where fossil fuels provide at least 25 percent of local tax revenue. As we’ve written previously with coauthors, this issue of public finance is hugely important. Nationwide, fossil fuels directly contribute about $138 billion in revenue to federal, tribal, state, and local governments each year.

But here’s the problem: no one knows how much revenue local governments get from fossil fuels. Although we have estimated fossil fuel revenues at a national level, no nationwide database provides this information at the local level, and most local-government budgets do not have line items for facilities or infrastructure related to coal, oil, and natural gas. For example, while many states and localities have line items for property taxes from oil and gas production, most do not report revenues from oil and gas pipelines, refineries, or fuel storage facilities. (Researchers at Resources for the Future and the University of Michigan, however, are working to develop estimates for how energy infrastructure—including clean energy sources—contribute to local-government revenue for up to a hundred counties in the United States. But trust us, it ain’t easy!)

Although clean energy can and will play an important role in some communities, federal policy that enables an equitable energy transition will need to include broader economic development, workforce development, public benefits, and other programs, so that today’s energy communities can thrive tomorrow.

What’s more, the text of the IRA is both overly inclusive and overly exclusive. The law stipulates “tax revenues related to” fossil fuels. But by using the phrase “tax revenues,” the law leaves out tens of billions of dollars that are generated each year from fossil fuel production on public lands, much of which funds local schools or state-run higher education. (Here’s a great example from Texas.) And by using the phrase “related to,” the law implies that not only direct revenue from fossil fuels should be included, but also indirect and induced revenues. Talk about data that don’t exist! Estimating direct revenue from fossil fuels is hard enough; trying to do the same thing for indirect revenue (such as tax revenue from purchases made by oil companies) and induced revenue (such as tax revenue from the restaurants where oil workers eat) is even harder.

Finally, the use of metropolitan and non-metropolitan statistical areas is far from ideal. Although calculating area-wide employment is straightforward, doing so for tax revenues is a herculean task. Calculating tax revenues would involve gathering data for every county government, city government, school district, and other taxing entity (e.g., library districts or fire districts) within a statistical area. For many areas—especially the big rural ones—this data crunching means trying to aggregate data (which don’t exist!) across hundreds of taxing entities. So, please spare a thought for the analysts in the Department of the Treasury who will need to sort this out.

This difficulty with the data is one reason why, in a recent public comment, Daniel suggested focusing these types of analysis on the county level. Although focusing on counties won’t solve every problem, the strategy would afford simpler analysis and, in all likelihood, enable resources to be better allocated to the energy communities that need those resources the most.

Putting It All Together

When we combine the maps above, the result seems to indicate that the IRA will designate about 50 percent of US land area as an energy community (Figure 4). This percentage excludes brownfield sites, which individually take up very little land area.

Figure 4. Our Estimate of “Energy Communities” as Defined by the Inflation Reduction Act

Data sources: See Figures 1–3 above.

So, let’s ask a big-picture question: Do these definitions in the IRA target the energy communities that are likely to be hardest hit by a transition to a net-zero energy system?

Because of the imprecision of the selected geographies, and the overly expansive definition of “energy communities” (especially as related to the employment metric), the answer appears to be no. In the coming weeks and months, perhaps new legislation or additional efforts by the Treasury Department can narrow the scope of the targeted regions and ensure that IRA incentives on this front can be more effective.

And, as joint work between Resources for the Future and Environmental Defense Fund has pointed out, clean energy will not be a one-for-one replacement for fossil energy in the communities that rely on coal, oil, and natural gas as their economic drivers. Although clean energy can and will play an important role in some communities, federal policy that enables an equitable energy transition will need to include broader economic development, workforce development, public benefits, and other programs, so that today’s energy communities can thrive tomorrow.

The federal Interagency Working Group on Energy Communities understands this point, and its efforts—including recently announced Rapid Response Teams that will work with specific regions where fossil fuels play a central role in the local economy—aim to provide a broad set of tools that energy communities can take advantage of. But as the United States and the world march toward a net-zero-emissions economy in the years and decades to come, a much larger effort will be needed to build an energy system that is more sustainable and equitable, including for the communities that historically have supplied the energy that’s driven global prosperity to date.

Notes on Data

All data that have informed this blog post, including geospatial data, are available via this downloadable file. We would like to note a few limitations in the data:

- For retired coal-fired power plants, exact coordinates don’t exist from 2010 to 2012. Instead, their ZIP codes are matched to the census tract with which they share the most land-area overlap.

- To calculate the percentage of the workforce directly employed in the energy sector, we sum the employment in North American Industry Classification System (NAICS) codes listed in Table 1, then divide by total employment. However, the IRA does not define which NAICS codes to use, nor whether to divide their sum by total employment or total labor force (which includes unemployed workers). The specific language in the IRA is, “extraction, processing, transport, or storage of coal, oil, or natural gas (as determined by the Secretary).” Two of these codes (213 and 486) include some non–fossil fuel activities, but overwhelmingly consist of jobs in the coal, oil, and natural gas sectors.

- Counties don’t map perfectly to statistical areas in New England. In the maps above, we show county-level data for New England.