Deploying hydrogen technologies as soon as possible can reduce costs and help the United States decarbonize quickly. But deploying green hydrogen before the grid decarbonizes can increase emissions in the short term. This trade-off between reduced costs and increased emissions will depend on the accessibility of the hydrogen tax credit—which largely depends on how the US Department of the Treasury chooses to implement it.

Addressing technology costs is an integral part of how we need to address climate change. Particularly in hard-to-abate sectors, including cement, iron and steel, and chemicals, the tools needed for decarbonization still are not widely deployed.

Two recent bills—the Infrastructure Investment and Jobs Act (also known as the Bipartisan Infrastructure Law) and the Inflation Reduction Act—place big bets on investing in and deploying new technology for decarbonization. The hope is that, by providing funding and tax credits for new technologies, we can make these technologies cheaper to build in the future. But sometimes a trade-off exists between near-term emissions and long-term deployment. In this blog post, I discuss how this trade-off complicates the implementation of the hydrogen tax credit in the Inflation Reduction Act.

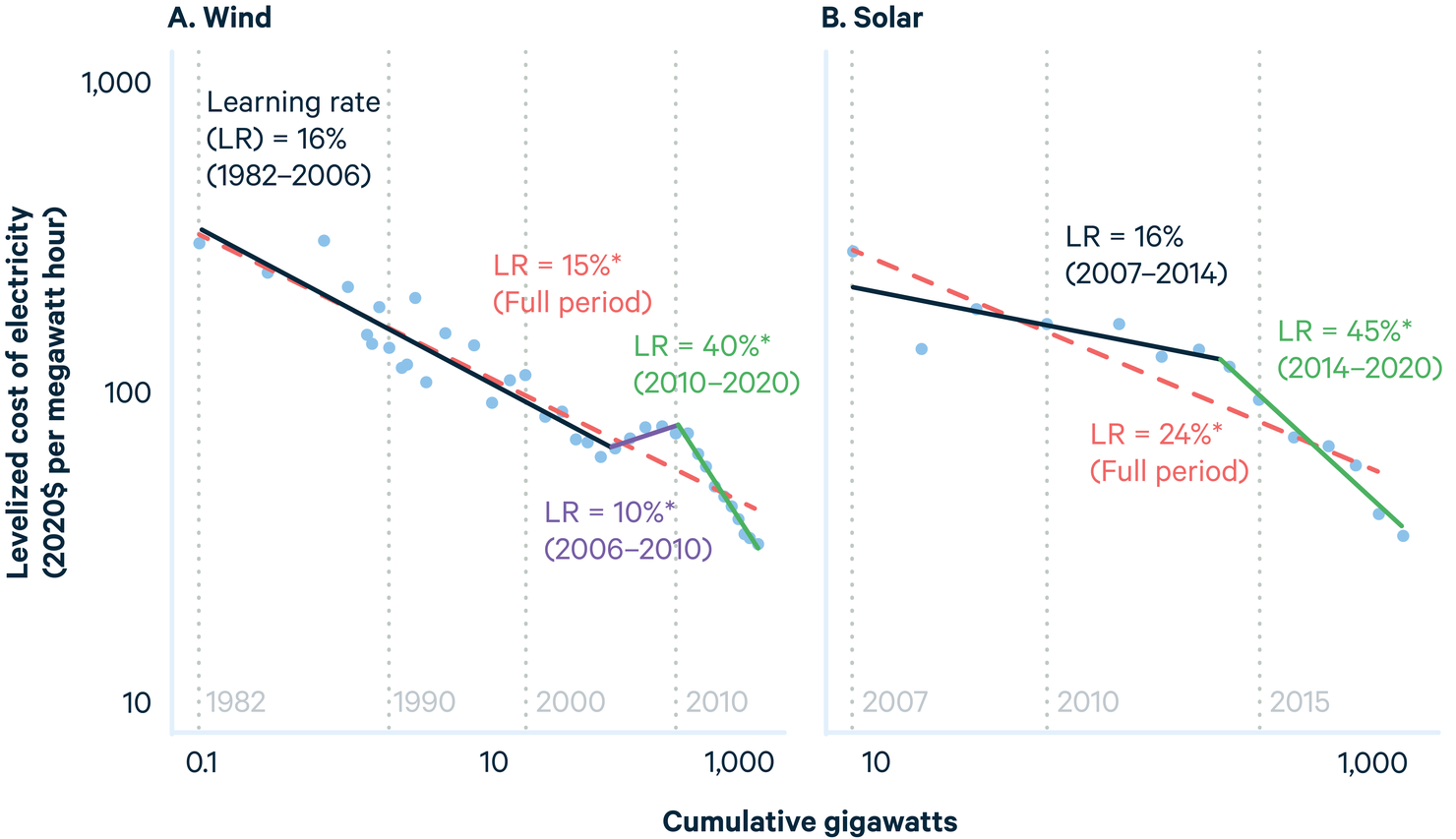

Decades of experience with new technologies shows that usually—though not always—the more you build, the cheaper things get. This pattern has been especially true with clean energy. Take wind and solar, for example. Recent research from Bolinger, Wiser, and O’Shaughnessy (Figure 1) shows the costs of wind power and solar power as a function of how much related infrastructure has been built.

Figure 1. The cost of technology decreases as more related infrastructure gets built

Each panel of Figure 1 shows the levelized cost of electricity on the vertical axis and the cumulative amount of capacity built on the horizontal axis. The scales are logarithmic because every time capacity doubles, the cost falls by a relatively constant fraction. The levelized cost of electricity is the price at which a generator, over its lifetime, must sell electricity to break even. One can see that the costs (mostly!) decline as more capacity is built. However, one also sees that the rate of cost decline can change, with costs even increasing for wind power over a small range.

The curves shown in these charts are called learning curves and show empirical relationships between technology deployment and cost declines. Importantly, these curves don’t explain how or why the learning occurs. Learning curves also aren’t universal, and a similar chart for nuclear power would show a different story. Nonetheless, learning by doing, as this phenomenon sometimes is called, is more the rule than the exception.

Learning by doing, and research and development more broadly, have implications for climate policy. Because not all of the gains from driving down costs are captured by a single business, it makes sense to subsidize technologies that have the potential to reduce costs through learning. Deployment takes time to ramp up: You have to work your way through the expensive deployment before lower costs can speed things up.

So, what does this mean for hydrogen? Although hydrogen is used already in refining and in the chemicals industry, its real potential for decarbonization is in steelmaking, process heat in industry, heavy-duty transportation, and long-term storage in the electric sector. Broadly, hydrogen can be made via two methods. The first is from fossil fuels, which generates greenhouse gas emissions that must be captured to meet net-zero goals. The second is with electrolysis, through which electricity splits water into hydrogen and oxygen. Electrolysis is still a nascent technology; almost all of the hydrogen generated in the world today is made directly from natural gas, which produces carbon dioxide that is vented to the atmosphere.

Given that electrolyzers are not yet widely deployed, they still have plenty of room to decrease in cost. The International Renewable Energy Agency, for example, projects dramatic declines for electrolyzer costs. But this learning—this cost reduction, in other words—cannot take place instantly and does not take place by the mere passage of time. Increasing volumes of electrolyzer construction are needed before costs can decline, and building new capacity takes time. If we want to take full advantage of these cost reductions and have cheap electrolyzers available for achieving net zero by midcentury, building them sooner than later will be important. Moreover, we also should consider subsidizing the production of electrolyzers to accelerate their deployment.

Which brings us to the tax credit for hydrogen in the Inflation Reduction Act. Unlike most other tax credits, the amount of credit that a hydrogen producer receives is based on the life-cycle emissions associated with that hydrogen producer’s activity. The life-cycle emissions include both the direct emissions at the site of the production and any upstream emissions. For example, in the case of electrolysis, this calculation would include emissions from the generation of the electricity that’s used by the electrolyzer, in addition to any emissions at the electrolyzer itself, say from hydrogen leakage.

The US Department of the Treasury has a lot to figure out as to calculating life-cycle emissions. Depending on the choices the agency makes, Treasury could make receiving the credit harder and more expensive for electrolyzers, if it applies a heavy emphasis on stringent emissions accounting. Importantly, electrolyzers that use electricity at the current average emissions intensity of the grid will produce life-cycle emissions that are too high to qualify for the tax credit. If Treasury makes choices that require less precise accounting, then receiving tax credits will be easier, but at the risk of inadvertently higher emissions. And, while I don’t discuss it here, some of the potential conditions that Treasury could identify may be difficult to implement, such as requiring that hydrogen production can consume electricity only when a specified renewable generator is generating electricity (known as 24/7 matching), which could further impede deployment. In summary, a trade-off is likely to arise between the certainty of near-term emissions reductions and the volume of electrolysis deployment.

The right answer may seem to be that we should make the emissions accounting as precise as possible. Why risk higher emissions? However, waiting to deploy electrolysis means that traveling down the learning curve will take longer, and the longer it takes to get down the learning curve, the more expensive—and presumably slower—future deployment will be. This hypothetical slower deployment means that either decarbonization will cost more, or industry will remain dependent on traditional fossil energy in the future. Arguably, the longer-term reductions from faster and cheaper electrolyzer penetration could more than offset any near-term increases in emissions from the current electricity grid.

As a final point, the 45V tax credit is not the only way the government is subsidizing hydrogen production. Hydrogen from fossil fuels, like natural gas with carbon capture, can receive $85 per tonne of carbon dioxide captured and sequestered under the 45Q tax credit. This version of the 45Q credit turns out to be comparable to a subsidy of around $1 per kilogram of hydrogen produced using natural gas with carbon capture. Because the 45Q credit is so straightforward, making the 45V tax credit more challenging may cause more producers to go with hydrogen from fossil fuels, as opposed to electrolysis, which would further slow future electrolyzer penetration.

Many are concerned that deploying too much electrolysis will increase emissions in the short term, and that concern is legitimate. But we also have to consider the long term and what we need to reach net-zero emissions. If green hydrogen is to be a part of that future, significant electrolyzer investments likely need to start now. Finding the right balance between these two considerations is part of the difficult task that Treasury needs to handle.