If you’re reading this blog post, you probably already know that over roughly the last ten years, US production of oil and natural gas has surged to all-time highs. The effects of this “shale revolution,” so-named for the types of rocks from which oil and gas have been newly tapped in vast quantities, have reverberated across communities, states, the nation, and the globe.

Scholars and activists have fiercely debated the answer to numerous questions, perhaps chief among them: is the shale revolution good or bad for addressing the challenge of climate change? Most analyses addressing this question have focused primarily or exclusively on the role of natural gas in the US, consistently showing that natural gas’s displacement of coal in the electric power sector has played a major role in reducing US emissions to levels not seen since the early 1990s.

But these analyses don’t tell us the whole story. In fact, if the shale revolution were a movie, the starring role would be played by oil, with natural gas in a supporting (though important) role. Since 2008, while US natural gas production has grown by roughly 40 percent, oil production has more than doubled.

Three Scenarios for US Oil and Gas

In my new RFF working paper, “The Greenhouse Gas Impacts of Increased US Oil and Gas Production,” I try to get a handle on the climate implications of the oil and gas boom.

To do so, I compare emissions in the year 2030 under three scenarios pulled from the US Energy Information Administration’s 2018 Annual Energy Outlook: one with high US oil and gas production (HOG), one with low US oil and gas production (LOG), and a “Reference” case, which is similar—though not quite the same thing—as a best guess (for details on these cases, check out the EIA’s full descriptions). Figure 1 illustrates oil (top) and natural gas (bottom) production since 1950 and projections to 2030.

Figure 1: US Oil and natural gas production history and projections under three scenarios

Data source: U.S. EIA. Note: Natural gas production includes “dry” natural gas and natural gas plant liquids.

To estimate US emissions under these three scenarios, I incorporate domestic carbon dioxide emissions based on EIA’s projections and a range of potential methane emissions based on estimates from the US EPA and a recent synthesis paper on the topic by Ramon Alvarez and colleagues.

My central estimate finds that in the US, greenhouse gas emissions in 2030 are about 270 million tons of CO2-equivalent higher under the HOG scenario compared to the LOG scenario. That’s about 5 percent higher, with a range of 2 to 10 percent depending on assumptions about methane emissions. In the HOG scenario, low-cost natural gas reduces the use of coal, but the resulting emissions reductions are more than offset by natural gas displacing zero-carbon energy sources (renewables and nuclear), coupled with higher methane emissions. US oil consumption and associated emissions also increase under the HOG scenario, but when it comes to greenhouse gas emissions, natural gas takes center stage in the US.

Think Globally

These results are fairly similar to what other studies have found on the long-term climate effects of low-cost natural gas in the US. But what about the role of oil outside of the US?

Natural gas and oil markets work differently. While increased domestic production of natural gas will mostly affect domestic prices, oil is widely traded on a global market. As a result, any large change in supply or demand can affect prices for consumers around the world.

The global (Brent) price for crude oil in 2030 is $82 per barrel under the HOG scenario, compared to $102 per barrel under the LOG scenario. As a general rule, these lower prices will lead to higher consumption. And while consumer responses to higher or lower oil prices tend to be fairly small in the short term (in economic terms, we would say that demand is inelastic), those responses can be more substantial over the long term.

For example, an expectation of low oil prices over the next few decades might reduce the incentive for individuals to purchase more fuel-efficient (or electric) vehicles; airlines might invest less in biofuels development; and petrochemicals manufacturers may further expand their operations, using oil as a feedstock.

Of course, estimating the magnitude of these effects is complicated. To come up with an informed figure, I gathered a range of estimates from recent research on the long-term price elasticity of demand for crude oil. In non-economist speak, these estimates measure the long-term consumer response to a change in oil prices.

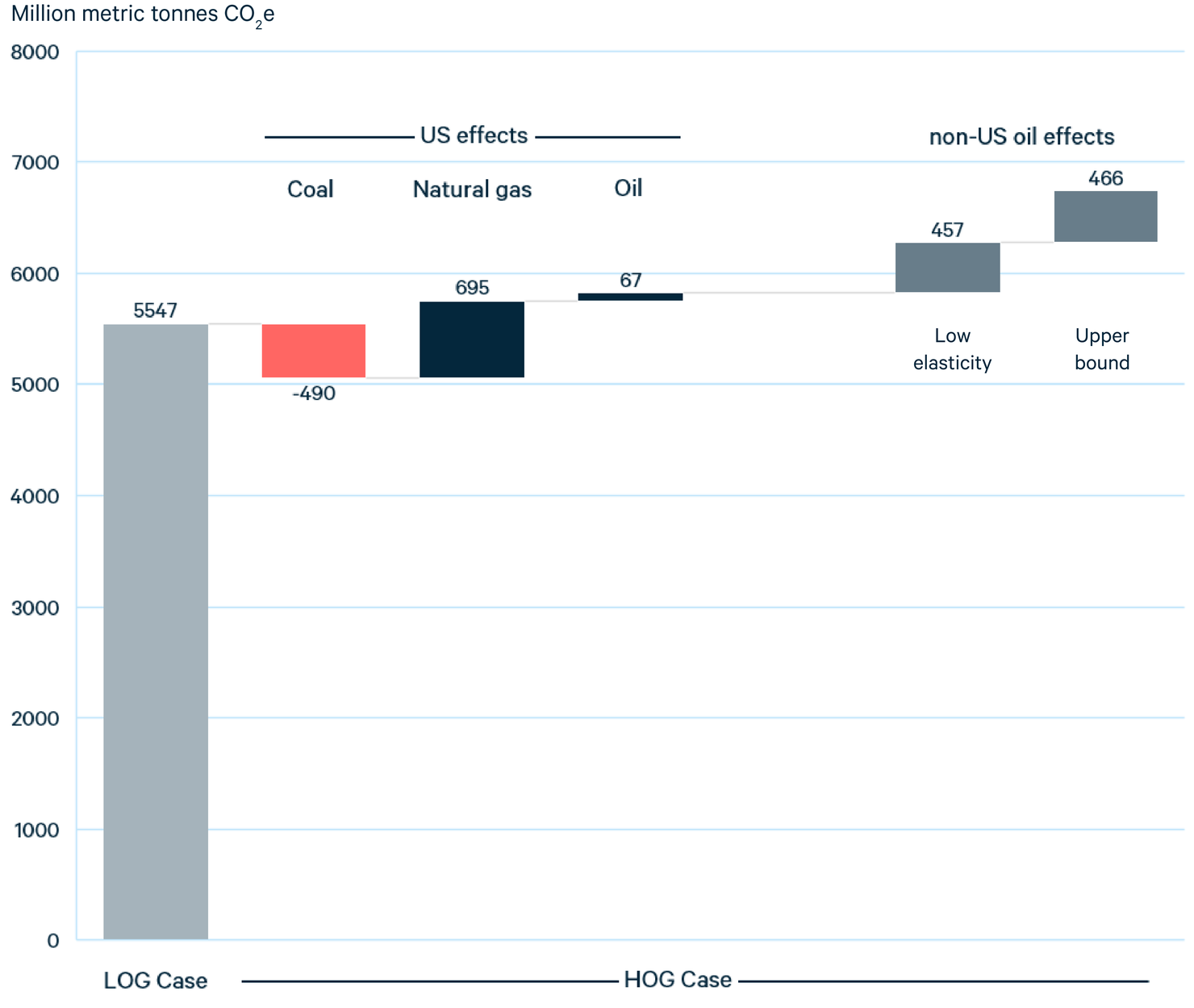

If we take the low end of these estimates (using a long-term price elasticity of demand for crude oil of -0.15), non-US oil consumption in 2030 is about 3 million barrels per day higher under the HOG scenario than the LOG scenario. That translates into an increase in CO2 emissions of about 450 million metric tons—almost twice the size of the US-only effect I described earlier. At the upper end, the difference could be about twice as high (though this high estimate is unlikely, as it doesn’t fully account for global supply competition). Figure 2 illustrates the differences in emissions under the HOG and LOG scenarios, incorporating both the US effects (for all fuels), and the global (oil-only) effects.

Figure 2: Greenhouse gas emissions under LOG and HOG scenarios

Summing the US and non-US effects, my central estimate is that greenhouse gas emissions in 2030 are about 730 million metric tons of CO2-equivalent higher under the HOG scenario than the LOG scenario. That’s a pretty big number. For context, emissions from fossil fuel combustion in Brazil in 2016 were about 420 million metric tons, and about 1,200 million metric tons for the entire continent of South America.

Known Unknowns

There are large uncertainties here, with two particularly big ones standing out. First, as mentioned above, estimating long-run demand elasticities is really hard, especially when technologies are changing rapidly.

Second, the Organization of Petroleum Exporting Countries (OPEC), in cooperation with other nations such as Russia, could act strategically to offset growing US supplies (EIA’s Brent price assumptions do not account for these types of strategic decisions on global supply). Indeed, this is already happening to some extent. However, it’s hard to imagine that the US oil boom won’t have at least some long-term effect on global prices.

Third, I don’t account for a variety of global shifts that could affect emissions. For example, I don’t estimate global emissions levels under different levels of US natural gas or coal exports, which would look different under the LOG and HOG scenarios. Nor do I try to calculate the upstream emissions from non-US oil supplies (e.g., methane emissions or flaring) which are being displaced by US crude.

There are more important assumptions that I won’t go into here. Instead, I encourage you to check out the full paper, where I lay out all of the key assumptions and limitations that help shape these findings.

Closing Credits

Along with these uncertainties, there remains the outstanding question of whether—despite the increase in greenhouse gas emissions—the US and the world might be better off overall under a HOG scenario. The shale boom has brought with it large-scale economic benefits, and the EIA estimates that US GDP would be about one percent higher under the HOG scenario than the LOG scenario in 2030. One percent might not seem like much, but it equates to about $277 billion in additional economic output in that year (in 2017 dollars).

GDP is most certainly not the same thing as welfare, so this is just a starting point. Looking forward, there’s lots more work to do to quantify the myriad costs and benefits of the shale revolution. But from a climate perspective, it appears increasingly clear that high levels of US oil and natural gas production are adding to the challenge of global greenhouse gas emissions.