There are real sea changes in the global energy industry, but they’re not all what you may think. It's worth considering what the data show in this sector: where there have been real, marked changes; where we expect changes in the near future; and where changes actually may be exaggerated or misunderstood.

In the energy sector, there are three major forces that interconnect and affect each other:

- Technological innovations

- Consumer preference and demand

- Policies and institutions that incentivize, govern, and constrain the other two more fundamental forces

Like the real sea, changes in the global energy system are a product of the ebb and flow, the constant push and pull, of these three different forces.

Shifts in Technology

The first major force of change in the global energy system, and arguably the most important, is technological innovation. New technologies reduce costs, create new ways of meeting consumer needs, and open up wholly new options for individuals, businesses, and policymakers to achieve their goals.

There are numerous technological innovations taking place in the energy sector, some of which are well-established, and others that are highly uncertain. One well-known example is solar and wind energy, where costs have fallen dramatically in the last 10 years, leading to widespread penetration in the power sector. Public policies have helped support their deployment, but the underlying technologies have improved substantially.

One emerging example is the trend toward electrification—the replacement of fossil fuel–based combustion with electric technologies that have the potential to reduce emissions. Here, there are as many questions as there are definitive answers:

- How quickly will the transport sector electrify? Will electric personal transportation be accompanied by shifts in trucking, marine transport, and aviation?

- How widely can electricity be deployed for heat-intensive industrial processes? What other low-emission options might be available, and what are the implications for different fuel sources?

- Is there a role for hydrogen to meet these hard-to-electrify energy needs, produced either by electrolysis from low-carbon electricity or from natural gas with carbon capture and storage?

- To what extent will the need to balance intermittent renewable supply with electricity demand be met by electricity storage technologies, or by a more flexible demand side enabled by automation and information technology?

In addition to these technological shifts surrounding the electrification of the energy system, there are major innovations underway related to carbon capture and use that will affect the future of fossil fuels in the context of achieving climate goals.

The most important is the deployment of carbon capture and storage at large scale to power plants and industrial sources. A more recent addition to the innovation landscape is direct air capture or carbon dioxide removal, where carbon dioxide is removed directly from the air (as opposed to flue gases). And related to both of these forms of carbon capture is the question of what to do with the CO₂, such as dispose of it underground as a waste, utilize it in enhanced oil recovery, or use it in the production of synthetic fuels or construction materials like cement.

In addition to renewable energy sources, the role of nuclear, hydrogen, and fossil fuels coupled with carbon capture in a low-carbon energy mix is both a technological as well as a market and policy issue, as these sources compete on the clean energy landscape.

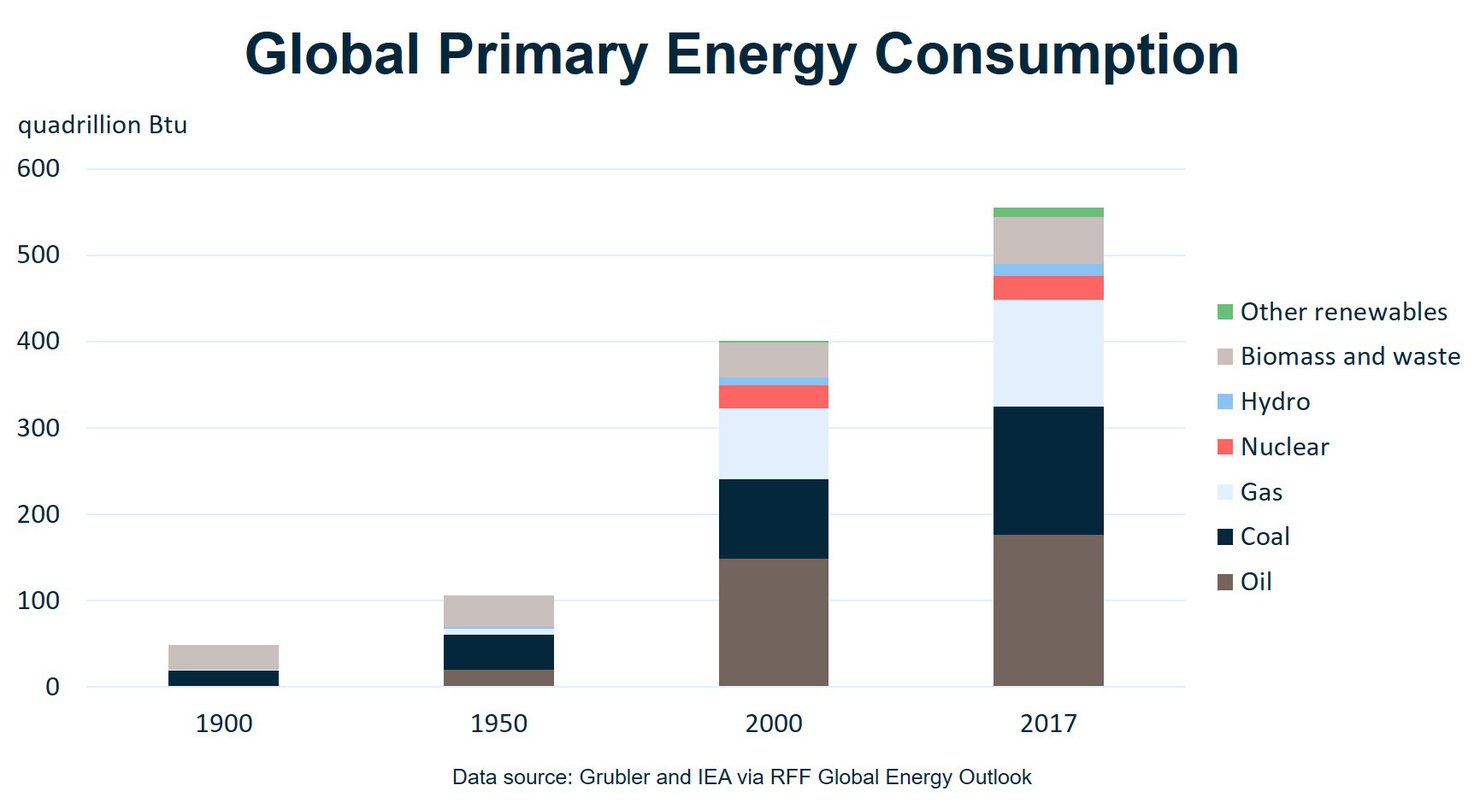

Now, with all of these exciting new technologies, along with the recent growth of renewables like wind and solar, you might expect that a fundamental global transition away from fossil fuels is well underway. But the reality is mixed, as this figure from RFF’s 2019 Global Energy Outlook demonstrates.

Historically, at a global level, there has not yet been an energy transition in the fuels we use. Instead, we’ve seen a series of energy additions—where one fuel source builds upon the next. The world today uses more wood, coal, oil, gas, hydropower, nuclear, and renewable energy than it ever has before.

For instance, biomass and waste comprised virtually all of the global energy mix in the year 1800, and while they comprise just about 10 percent of global energy today, in absolute terms, the world uses three times more biomass and waste than it did two centuries ago.

Over the past 20 years, we have continued to see global energy additions—not a clear transition—at least at the global level. Compared with the year 2000, while wind and solar have more than tripled, coal consumption is up by 62 percent, oil by 18 percent, natural gas by 50 percent, nuclear by just two percent, hydropower by 57 percent, and biomass and waste by 35 percent. So although modern renewables like wind and solar have grown rapidly, they still represent just two percent of the global energy pie.

This is indeed the challenge to the energy industry and policymakers—that at a global level, a substantial transition to a low-carbon energy system has not yet taken hold, while the climate challenge urgently requires that an energy transition reduce our reliance on energy sources that emit carbon to the atmosphere. And we do see leading indicators of change, with some nations and regions demonstrating that an energy transition is possible, supported by technology shifts and public demands pulling and pushing in that direction.

Where localized transitions are taking place, they have often been a product of wind and solar deployment, driven largely by policy decisions that have increased deployment and investment and in turn lowered technology costs. On a levelized cost basis, the cost of producing electricity from wind has fallen by about 70 percent in the last 10 years, and for solar photovoltaics, it’s fallen by almost 90 percent. Here, we have policies driving technologies, and technologies in turn driving markets.

Other technological developments have made waves in the energy system. The shale revolution has dramatically reduced the cost of producing oil and gas in the United States, and that’s had a profound effect on markets, and to some degree on US policy. During the Obama administration, the Clean Power Plan was designed in part to take advantage of the low cost of natural gas as a substitute for coal. And in the Trump administration, increased US energy exports are described as a tool to shape international relations.

As all of these new technologies emerge, markets and policies will have to adapt. For example, how will grid managers and regulators incorporate higher levels of renewables into the mix, and how will they facilitate deployment of energy storage, demand side flexibility, and fast-ramping capacity? What types of policies will be appropriate to ensure the long-term security of carbon that is stored? How will consumers respond to automation in helping them make decisions about their home energy use or in transporting them around?

Market Demand

The second major force of change in the global energy system is the demand of the marketplace. Consumer demand, along with investor decisions, manifest as market forces that have meaningful influences on the global energy sector. For example, we see an increasing number of companies committing to purchase 100 percent clean electricity. Global corporations ranging from Google and General Motors to Walmart have all made commitments in this area.

These developments are coming at increasing speed. An industry group called Renewable Energy Buyers Alliance now includes these companies and more than 300 others. This year, Walmart announced a commitment to reduce a billion metric tons of emissions from its global supply chain by the end of the next decade. This spring, the CEO of Occidental Petroleum announced the goal of becoming carbon neutral. This summer, the world’s largest shipper, Maersk, announced the goal of having net-zero CO₂ emissions from its operations by 2050 and net-zero vessels in operation by 2030. BHP also announced a $400-million effort to reduce its emissions. The list could go on.

Given the scale of corporations involved, and their global reach, it’s clear that these decisions in the marketplace have the potential to drive forward renewables and zero-carbon technologies.

Investor decisions also have important consequences for technologies. Investors are becoming more confident in the ability of renewables to deliver a return, which affects the costs of public policies and changes the calculus for those looking to fund new innovations. Investors are looking more closely at the long-term profitability of incumbent energy sources such as coal. And investors are demanding more disclosure about long-term risk related to both the impacts of carbon constraints and the risks of climate change itself.

These shifts in markets and technology aren’t “siloed.” They also have major implications for policymakers. For example, we’ve seen a rapid decline in coal consumption in the United States and other countries, driven not just by policy, but by technological innovations in natural gas and renewables, along with demand for cleaner energy from consumers. This has raised profound policy questions: What types of policies are appropriate to help affected communities adapt to the decline of traditional fossil fuel sources? What types of new technologies, in the energy sector or elsewhere, can help these communities thrive in the future?

This mixing of the multiple currents of the energy transition, economic transition, and social change is increasingly evident in proposals such as the Green New Deal and the social movements to which it is connected.

Policy Shifts

When a government enacts a meaningful change in public policy, it sends ripples that change incentives for individuals and companies developing new technologies and participating in today’s markets. Consider carbon pricing. Dozens of governments around the world and at the state level in the United States have adopted some form of carbon pricing, either in the flavor of a carbon tax or a cap-and-trade program. Here, we have an example of a policy shift that fundamentally changes the marketplace. Utilities that previously would have built a new natural gas or coal power plant might now be encouraged to build more renewables or keep a nuclear plant online. Consumers looking for a new car may likewise pick a more fuel-efficient or electric vehicle.

Those price signals affect technology, too. Not just the technologies deployed today, but the technologies under development for tomorrow. Carbon pricing, if it is seen to be durable, will encourage entrepreneurs to spend more on new technologies to reduce emissions for the next product cycle and to look for new ways to reduce emissions in the years ahead.

Performance standards are another good example. Fuel economy standards for cars and appliance efficiency standards require companies to meet certain thresholds for performance for the products they sell. Consumers might not always be aware of these standards, but they are certainly shaping the market.

Another example of a policy that allows flexibility and drives market and technological change is a low-carbon fuel standard. This type of policy sets a regulatory target for the carbon content of fuel, which can be achieved by blending more biofuels with gasoline, going electric, and other options. In California, a low-carbon fuel standard has helped to reduce the carbon intensity of fuels by around five percent since 2010. Emissions credits for the program have been trading at $190 per ton, and now, with new eligible pathways added to the program, provide a way forward for technologies like direct air capture of carbon dioxide, which is then stored underground or possibly in a product.

State renewable portfolio standards (RPS) are also undergoing major shifts. State RPS policies require that a portion of a utility’s sales come from renewable energy technologies. More than half of US states have a renewable portfolio standard, with important potential consequences for the power mix and for power markets.

Recently, some US states have gone well beyond RPS targets and are pushing for deep decarbonization in the power sector and, in some cases, across their entire economies. Over the last year, California, the District of Columbia, Maine, Nevada, New Mexico, New York, and Washington have committed to either 100 percent renewables or carbon-free electricity production by midcentury. This is a substantial change: only Hawaii had a similar a target of 100 percent renewable electricity in place prior to 2018.

Developments in California and New York are particularly important. If it was a country, California would be the world’s fifth-largest economy, while New York’s economy is about the size of Canada’s—the tenth largest. Together, the two states comprise nearly one-fifth of the US population. California has committed to 60 percent renewable power by 2030 and 100 percent carbon-free electricity by 2045. This summer, New York committed to 100 percent carbon-free electricity by 2040 and went a step further by targeting economy-wide, net-zero emissions by 2050.

More than 100 US cities have also committed to 100 percent clean electricity, and other countries are doing something similar. This summer, the UK also set a target of net-zero emissions by 2050, becoming the first country in the G7 to do so.

These policies are ambitious, and we don’t yet know how they will be implemented. We do know that states committing to carbon-free electricity, rather than to renewables only, stand a better chance of spurring a broader and more cost-effective range of innovations. Because they are more inclusive in the range of eligible technologies, zero-carbon standards allow utilities and others to go to higher levels of clean and find the most efficient ways of displacing emissions, instead of constraining them to use specific technologies which—10 or 20 years from now—might not be as competitive. Most US states, as well as nations pursuing deep decarbonization, are using a mix of policies, combining carbon pricing in some sectors with standards and mandates in others.

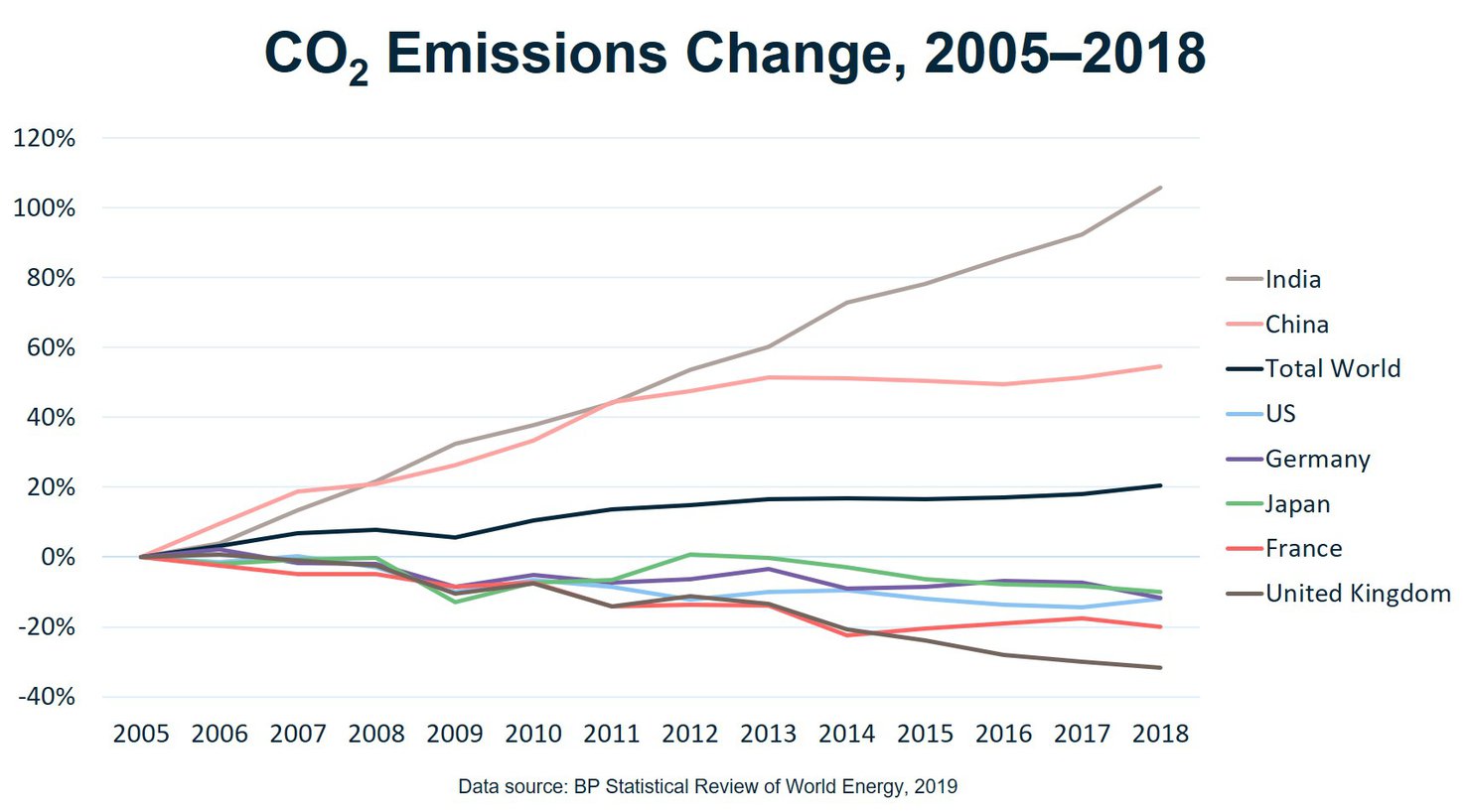

So where do we stand in terms of reducing emissions from the energy system? Over the last 15 years or so, the United States has made substantial progress, due to a combination of policies and market forces. Compared to the year 2005, US CO₂ emissions in 2018 were 12 percent lower. How does that stack up with other major industrialized nations?

In Europe, some nations have seen strong economic growth and even deeper reductions in emissions, led by the UK, where emissions are down more than 30 percent since 2005. France has reduced emissions by 20 percent, and Germany has reduced emissions by 12 percent, equal to the reduction in the United States on a percentage basis. In Japan, emissions have decreased by about 10 percent since 2005.

But these reductions have been more than offset by growing emissions from developing economies, led by China, where emissions have increased by 55 percent since 2005, and India, where they have more than doubled, as these countries developed and their incomes rose. Overall, global CO₂ emissions in 2018 were 20 percent higher than in 2005.

In Europe, where we’ve seen the greatest reductions, public policies have played a major role. Looking forward, policies will need to become substantially more ambitious and ubiquitous globally to achieve long-term climate goals such as those outlined in Paris in 2015.

So, what can we learn when we start to tie together these three key forces of technology, market demand, and policy?

One key question is whether we are on the cusp of a new type of disruptive change in the energy system. Historically, we’ve seen that changes in the energy system occurred incrementally over decades, and mainly in response to changing technology and consumer demand.

But as we look to the future, we see the potential for more rapid shifts and more in response to public demands for clean energy alongside affordable energy. These are the shifts that have the potential to address the scale of the climate challenge, and the challenge of meeting global energy demands. A combination of technological innovation, flexible markets, and ambitious policies would be necessary to make them a reality.

But as economists often like to point out, there are almost always unintended consequences to changes—especially large or rapid changes. An increasingly important issue as we consider the consequences of deep decarbonization is, therefore, being attentive to the stranding of people and assets during a period of transition. This is critical not only from the point of view of fairness, but also from a purely pragmatic perspective.

Disruptive change in the energy system can help or hinder the global energy system. Markets and technologies can help us achieve our long-term policy goals, both in terms of climate change and in terms of increasing energy access and improving livelihoods around the world. To make that happen, policymakers need to think carefully about how the waves they make will ripple across the global energy system.

This text comes from a speech delivered by Richard Newell as one of the opening keynote speakers for the Dentons Energy Horizons Summit at the Dentons office in Washington, DC on July 30, 2019.