Prices of coal, oil, and natural gas are spiking. Although high energy costs hurt consumers, the situation offers an opportunity for energy-producing states to invest windfall tax revenues and make communities more economically resilient in the long term.

Energy prices are high, and consumers are hurting. With crude oil prices topping $110 per barrel and natural gas prices at levels not seen for 15 years, policymakers at the state and federal levels are facing enormous pressure to find a way to lower prices. In response, the Biden administration has tapped the Strategic Petroleum Reserve, while some states have (perhaps unwisely) suspended their gasoline taxes.

But for some states, high energy prices are a boon. In Wyoming, New Mexico, Alaska, North Dakota, Texas, Oklahoma, Louisiana, and even parts of California, Colorado, Ohio, Pennsylvania, and Utah, high energy prices translate into not just jobs, but also surging government revenue.

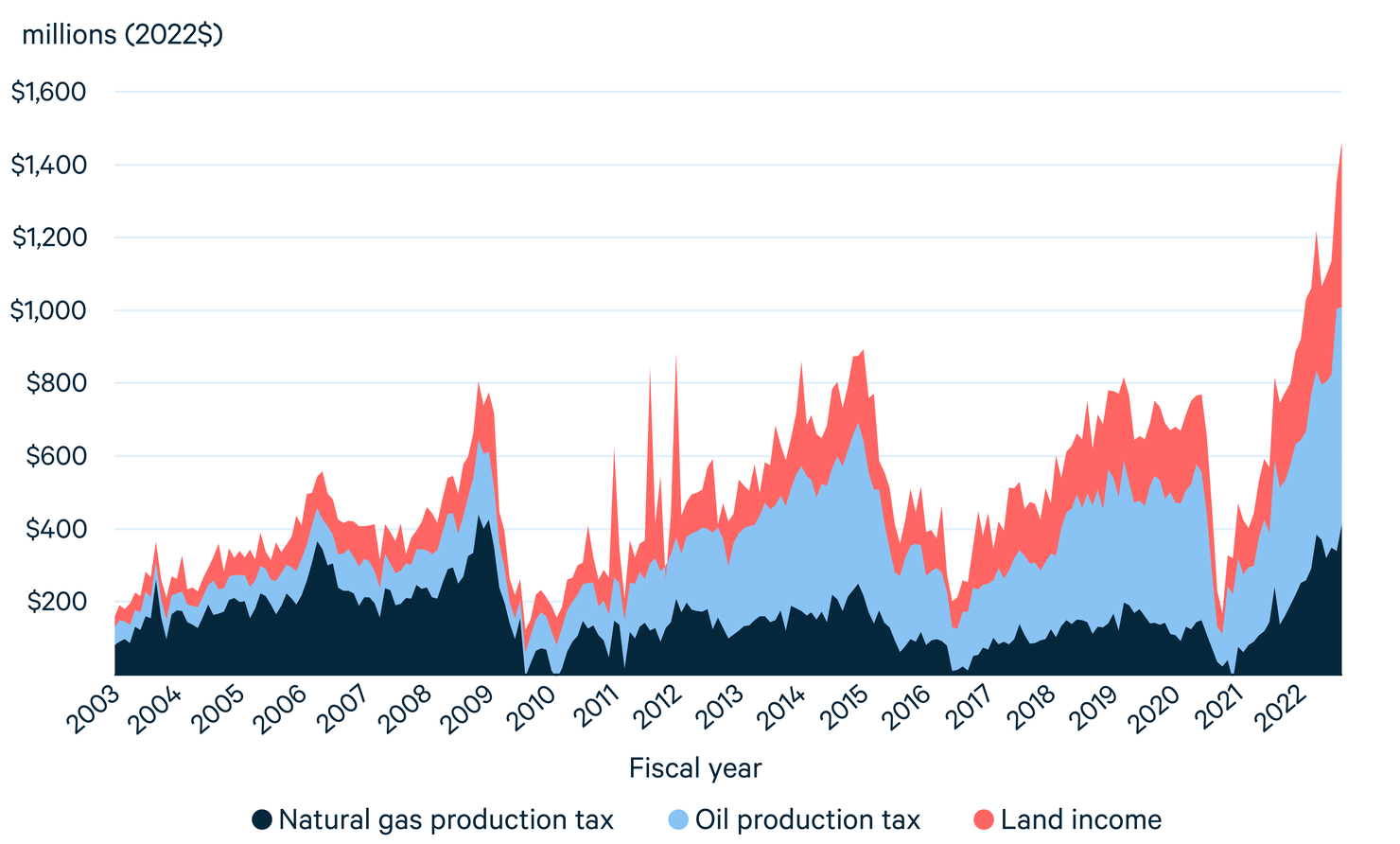

Consider Texas, the nation’s leading oil and natural gas producer. For most of fiscal year 2022, the state has raked in more than $1 billion per month from taxes on oil and gas production, along with revenue from state lands (led by royalties from oil and gas production on state lands). That’s more than twice the average level of monthly revenue from those same sources in fiscal years 2003 to 2021. And, let’s remember, those were the years of the shale revolution, which saw the state’s production surge to all-time highs.

Figure 1. Texas State Government Monthly Revenue from Oil and Natural Gas Production

Data sources: Texas Comptroller of Public Accounts for revenue. Federal Reserve Bank of St. Louis for inflation adjustments. Accessed June 2, 2022.

The first thing to notice in Figure 1 is the extreme volatility exhibited by these revenue sources. Because of this volatility, researchers have argued extensively that prudent policymakers ought not to rely too heavily on oil and gas revenues to fund general expenditures, as annual funding for schools, roads, or other basic services shouldn’t be subject to such extreme whipsaws. Instead, states would ideally invest a large portion of their oil and gas revenues into long-term savings funds, allowing state governments to fund services with a permanent and predictable stream of investment returns.

Some states, such as Alaska, New Mexico, North Dakota, and Wyoming, have followed these policy recommendations by investing a substantial share of resource revenue into permanent funds. Famously, Alaskans get a check each year from the Alaska Permanent Fund, which also buffers state government revenue when oil prices take a dive.

But other states, including Texas, Oklahoma, Louisiana, Ohio, Pennsylvania, and West Virginia, save far less of their oil and gas revenues. Some, like Pennsylvania and Ohio, hardly tax oil and gas production at all, even failing to generate substantive revenues for their general funds.

This Time Is Different

So, if states haven’t invested their natural resource wealth into long-term savings funds over the past several decades, why would they be inclined to do so now?

The answer is simple: Climate change. As the United States and the world move toward a net-zero-emissions future, oil and natural gas will play a more limited role in the economy. Although the rate of decline will depend on the pace of the energy transition, oil and gas extraction are likely to decline considerably under any ambitious effort to reach net zero.

But states still have a window of opportunity. Oil and natural gas will continue to play a major role in providing revenue among states and localities for at least another decade or so, even under ambitious efforts to reduce emissions. Instead of using those revenues to cut taxes or spend on near-term priorities, policymakers can make the smart choice to invest the windfall in long-term savings funds and enhancements to local economic diversification, making energy communities more economically resilient—regardless of what happens with climate policy.

To illustrate the costs of not taking such actions, all we need to do is look to US coal communities, especially those in Appalachia. Most US coal-producing regions have failed to invest their natural resource wealth in permanent funds and have struggled to diversify local economies. As coal production and employment have declined over the past several decades, the results have been distressing: high levels of poverty, unemployment, substance abuse, and more.

Oil and gas communities can avoid this distressing future by applying smart policy. And there’s no better time than right now—a moment when oil and natural gas producers are enjoying record profits, and when states are earning record levels of revenue—to update fiscal policy and provide a firmer foundation for future generations.