An element of climate policy known as an emissions cap (or carbon cap) would complement the Inflation Reduction Act, help the United States meet national climate goals for 2030, and reduce air pollution and electricity prices for consumers.

Editor’s note: Scholars at Resources for the Future (RFF) recently published a research paper in the academic journal Economics of Energy and Environmental Policy about the potential effects of implementing an emissions cap in the United States. Earlier this month, the Environmental Defense Fund provided a summary of this journal article in a blog post on the organization’s Climate 411 blog. A lightly edited version of that article is excerpted below.

Another blog post, previously published on RFF’s Common Resources blog, shares more about the research that’s featured in the article excerpt.

As we race to decarbonize the economy this decade, the Inflation Reduction Act (IRA) has provided an enormous economic opportunity for the clean energy industry. With costs of deploying clean energy solutions becoming so low, we are in a critical window of time to adopt new carbon policies and lock in “cost-optimal” model projections and go beyond them to realize a pathway for the United States that’s consistent with a 1.5°C warming trajectory.

However, according to a recent report by Rhodium Group, the United States is not on track to meet its nationally determined contribution (NDC) goal of 50–52 percent economy-wide emissions reduction in 2030 from 2005 levels, with Rhodium Group projecting a reduction of only 32–43 percent.

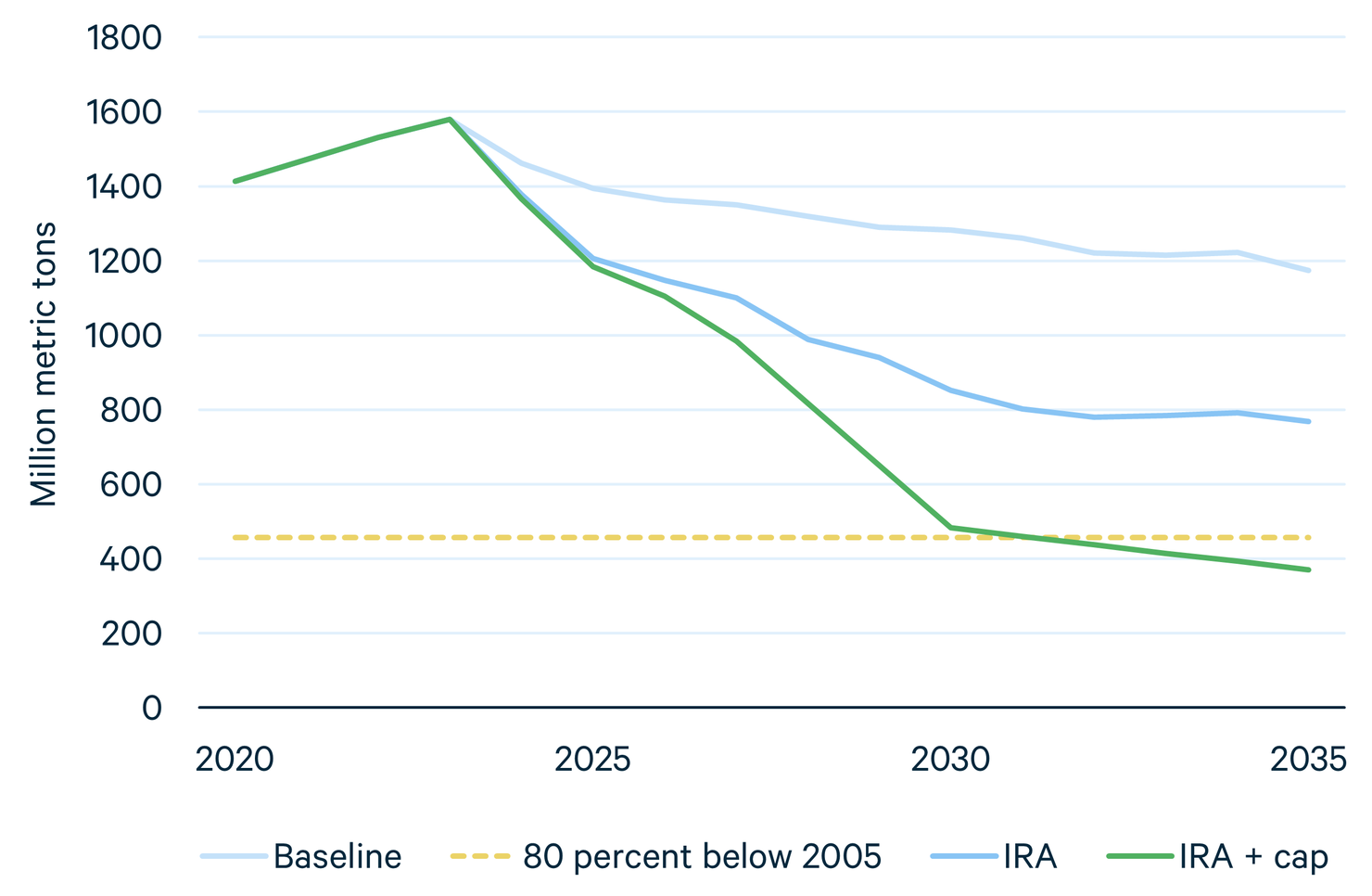

With this carbon-policy imperative in mind, a new peer-reviewed journal article, building on a working paper by Resources for the Future, demonstrates how policies that constrain carbon emissions in the power sector could unlock the full potential of IRA incentives in order to achieve the economy-wide goal of 50–52 percent emission reductions from 2005 levels under the US NDC, with 80 percent emissions reductions in the power sector.

Figure 1. Greenhouse Gas Emissions from the Power Sector Under Modeled Policy Scenarios

Notes: IRA = Inflation Reduction Act

The article finds that combining a carbon cap with the IRA significantly drives down the cost of achieving reductions to meet the cap. Modeling showed a marginal abatement price of $27 per ton to achieve 369 million tons of additional abatement and reach 80 percent power-sector emissions reductions by 2030, compared to 2005 levels, which is nearly 60 percent cheaper when compared with model scenarios that have only a carbon cap, without the IRA. The combination of a carbon cap with the IRA would also lower consumer costs this decade to roughly $114 per megawatt-hour, compared to $117 per megawatt-hour without either policy in place, and create significant net climate and health benefits due to deeper reductions in fossil fuel pollution.

Figure 2. Net Benefits and Costs Under Modeled Policy Scenarios

Notes: IRA = Inflation Reduction Act; PM2.5 = particulate matter less than 2.5 microns in diameter

Background

The US NDC is ambitious and aligned with recent decisions made at the 28th Conference of the Parties (COP28) that are consistent with keeping a 1.5°C warming trajectory within reach. Achieving the NDC would demonstrate global climate leadership and be significant, given that the United States contributes about 11 percent of global emissions. The power sector is the core component for achieving the NDC, with numerous studies continuing to show that the majority (about two-thirds) of near-term abatement is projected to have to come from the power sector. Moreover, the power sector plays a key role in decarbonizing the economy through electrification of other sectors such as buildings, transportation, and heavy industry.

To reach the 2030 target, US power-sector emissions need to drop by roughly 80 percent by 2030, compared to 2005 levels, or “80×30.” This goal will require rapid acceleration of decarbonization in the electric power sector, striving to triple the annual deployment of new clean energy projects and phase out fossil fuel pollution—consistent with the COP28 pledges.

Recent federal and state-level policy actions are accelerating progress toward 80×30. The IRA and the Infrastructure Investment and Jobs Act have changed the economics of decarbonizing the power sector and paved the way for a cost-optimal pathway to clean energy. If realized, this pathway, in tandem with state policies and company-level actions, could contribute to a significant portion of the emissions reductions needed in the power sector and across the economy to meet the NDC target. However, there are both risks to locking in the cost-optimal trajectory under the IRA projected by models and opportunities to go beyond the IRA in order to fully unlock the potential of the power sector to drive progress to the NDC target.

We are already seeing a powerful effect from the incentives in the IRA, which are projected to unlock around $390 billion of spending on energy and climate through 2022–2031. Of this amount, around $160 billion (41 percent) is expected to be spent on tax credits for clean electricity, underlining the significant investment the IRA makes in the power-sector transition and the importance of maximizing its implementation. The tax credits are also uncapped, in that there is no limit in the legislation that restricts government spending on them.

The Problem

Despite this promise, a wide range of model projections reflect uncertainty in the degree and magnitude of IRA implementation, as well as other pressures such as increased demands and risks to faster clean deployment. Model projections assume “cost-optimal” conditions, whereby decisions to build, maintain, and/or retire power generation are optimized for system costs, which may differ from real-world investment decisions.

According to a study examining multiple models, power-sector emissions are projected to fall by 47–83 percent below 2005 levels in 2030. RFF’s power-sector modeling is consistent with this range, projecting a decrease of 44–63 percent, falling short of 80×30. And across the economy, reductions from the IRA are projected to be 33–40 percent below 2005 levels in 2030 with a 37 percent average, below the 50–52 percent NDC target.

The Solution

The challenge ahead for the power sector is to lock in these cost-optimal trajectories and maximize the potential benefits of the IRA—and close the gap to reach 80×30. The RFF working paper offers a potential policy solution by combining the IRA incentives with a carbon-emissions cap that constrains the total amount of carbon dioxide emissions in the power sector over time and ensures that electricity demand must increasingly be met by zero-emission electricity generation. While the RFF analysis looked at the interaction of the IRA and emissions-cap policies at the federal level, the same dynamics exist with state or regional caps, as well.

Read the full blog post from the Environmental Defense Fund.