The recently proposed Inflation Reduction Act contains tax credits that boost adoption of medium- and heavy-duty electric vehicles. Importantly, the credits encourage sales of relatively smaller vehicles. RFF Fellow Beia Spiller explains why.

The Inflation Reduction Act of 2022 (IRA) contains two tax credits that target the accelerated adoption of medium- and heavy-duty electric vehicles (MHD EVs). Provisions in the IRA provide a tax credit for the purchase of the vehicle itself (Section 13403), and a tax credit for the purchase and installation of charging assets or charging infrastructure (Section 13404).

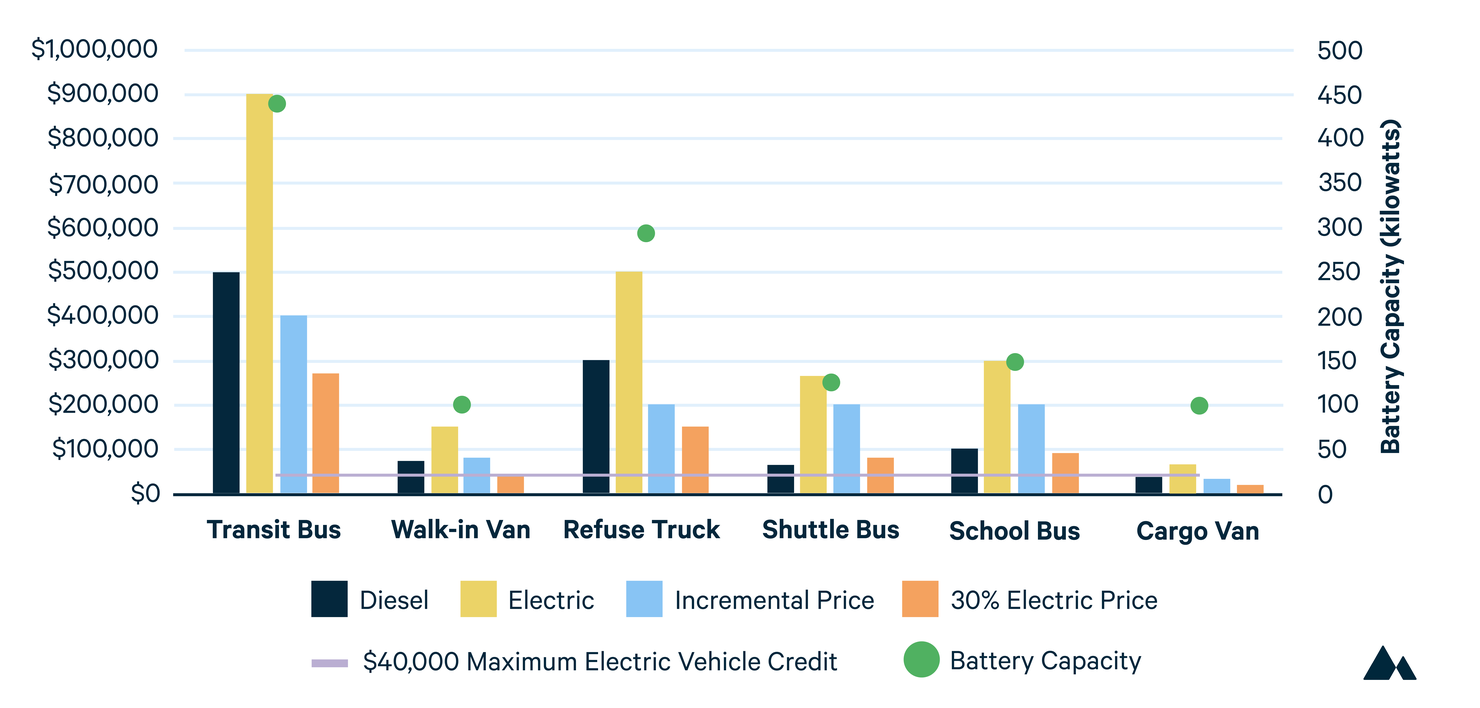

The vehicle purchase incentive in Section 13403 provides a tax credit for each purchase of an MHD EV, covering either the vehicle’s incremental cost (the difference in price between a diesel vehicle and the electric counterpart), or 30 percent of the electric vehicle’s purchase price—whichever is less. However, the maximum allowable amount of the MHD EV tax credit is capped at $40,000 per vehicle purchase. For the infrastructure tax credit, the IRA provides 30 percent of the cost per charger, up to $100,000. This means that an existing fleet of vehicles that wants to add multiple chargers could claim tax credits for each separate charger they install on their property, significantly reducing the cost of electrifying the fleet.

The present structure of the two provisions has important implications for the types of MHD EVs that are most likely to be adopted. For instance, the IRA inherently incentivizes adoption of the smaller MHD EVs. Why does it look as though the credits favor relatively smaller vehicles? Smaller MHD vehicles, such as cargo vans or box trucks used for short-haul package delivery in urban areas, are cheaper and have more similar price points relative to their electric versions than larger MHD vehicles, such as long-haul tractor trailers.

Figure 1 compares the prices of the diesel and electric versions of representative MHD trucks and buses. Included in this figure is the incremental price and the 30 percent base price of the EV counterparts, with the $40,000 cap highlighted. Notable in Figure 1 is that the maximum allowable credit amount fully reimburses a fleet owner only in the case of electric cargo van purchases. Even walk-in vans, one of the least expensive MHD vehicles, have an incremental price that is larger than the offered $40,000 limit.

Figure 1. Investment Costs for Different Types of Medium- and Heavy-Duty Vehicles

Horizontal line across the bars indicates the maximum allowable tax credit of $40,000 per vehicle purchased, as specified in the Inflation Reduction Act. Data from AFLEET 2020.

An additional factor that may help explain why the IRA incentivizes smaller MHD EV adoption is battery size. As shown in Figure 1, these types of EVs contain smaller batteries, which is one factor that helps explain its similar price point compared to diesel-powered vehicles of similar size. Smaller batteries mean that smaller MHD EVs likely will require smaller charging stations—which likewise are significantly cheaper. Large, fast chargers can cost over $150,000, particularly when electrical service upgrades in a depot are needed.

Given the level of the tax credit caps, the federal government seems to be focusing implicitly on fleet electrification in the small MHD vehicle space. However, for these small MHD EVs, such as cargo vans, step-in vans, box trucks, and pickup trucks, government intervention may be less necessary from a purely economic perspective, given their lower up-front cost and higher vehicle miles traveled. In fact, studies have found that investments in these vehicles result in positive net present value to the fleet owner, given their investment costs, vehicle miles traveled, and refueling costs. Why, then, are we still seeing so little adoption of these other types of small MHD EVs? The reluctance to electrify may be due to range limitations, range anxiety, uncertainties about new technologies, misinformation, electric grid challenges, and other factors. It’s possible that the subsidies in the IRA will provide the necessary compensation to offset the negative aspects of fleet electrification—whether those negative factors are real or perceived.

We will continue to follow the course of MHD vehicle incentives in the IRA and update our discussion as needed. Stay tuned in this space for further coverage.

Editor’s note: A previous version of this article mischaracterized school buses as belonging to a category of MHD vehicles which would be covered by the tax credits that apply to commercial vehicles in the IRA, whereas school buses actually could benefit more from other provisions found in the Infrastructure Investment and Jobs Act. This current version of the article omits the prior references to school buses.