A hydrogen tax credit could enable long-term technology development and cost-effective emissions reductions in the near term. A tax credit for clean hydrogen will likely appear in the Build Back Better Act, but the details keep changing—and from the most recent House draft of the bill, not for the better.

Numerous hydrogen policies have been introduced or proposed over the past year, and tax credits for clean hydrogen production were included in two recent drafts of the Build Back Better Act in the US House of Representatives. If the incentives are well-designed and sufficiently generous, then clean hydrogen tax credits could accomplish two important climate objectives: First, the tax credits could support the long-term development of hydrogen production pathways that would result in minimal greenhouse gas (GHG) emissions. Second, the tax credits could help decarbonize current hydrogen production, which itself is a significant source of GHG emissions.

Supporting Green Hydrogen for Novel Applications, with Long-Term Climate Benefits

Hydrogen has vast potential in climate change mitigation, both because consuming hydrogen produces no GHGs (even if producing hydrogen can result in emissions) and for its versatility—hydrogen could be used in the power, industrial, transportation, residential, and commercial sectors. In a report published last year, we assessed the prospects for clean hydrogen as a source of industrial heat, as feedstock in steelmaking, and for long-term energy storage. In these novel applications, hydrogen would displace the incumbent fossil fuel—typically natural gas or coal. Given (a) the low costs of natural gas and coal, (b) the comparatively low carbon footprint of natural gas, and (c) the existence of other decarbonization solutions (e.g., end-use carbon capture, utilization, and storage [CCUS]; electrification with zero-carbon power; biomass), clean hydrogen will have to achieve very low cost and emissions profiles to be competitive in these applications.

Although multiple hydrogen production pathways may eventually meet these cost and emissions requirements, “green” hydrogen—produced by splitting water with renewable or nuclear power—has received the most interest. Because green hydrogen is not derived from natural gas, its cost trajectory is not constrained by the price of natural gas, which it would compete against in many applications. For example, an alternative to using green hydrogen to generate power or heat would be natural gas combustion with CCUS. Current green hydrogen costs are high, but with reductions in electrolyzer costs and renewable energy prices, green hydrogen is projected to be the cheapest form of clean hydrogen within the next 20 years.

All the recent proposals for a clean hydrogen tax credit would provide an incentive of $3 per kilogram of hydrogen produced with nearly zero life-cycle GHG emissions. As we discuss later in this article, this incentive is very high when measured in terms of its immediate climate benefits, but the objective of the $3-per-kilogram hydrogen credit is to spur the growth of green hydrogen because of its widespread potential in future decarbonization. The high incentive is necessary, given that current production costs for green hydrogen in the United States are estimated to be between $4 and $7 per kilogram of hydrogen.

Policies for solar power over the past 12 years may provide a useful comparison for green hydrogen incentives. In 2008, the federal investment tax credit for solar power was extended for eight years, providing solar projects with a tax credit of 30 percent of their capital costs. With average costs of nearly $5.50 per watt for utility-scale solar projects in 2010, the credit effectively amounted to $1.64 per watt. Assuming typical solar-project characteristics (25 percent capacity factor and 6 percent real discount rate), and assuming that solar displaces natural gas as a source of electricity, the cost of the solar investment tax credit in terms of emissions abated would have exceeded $130 per ton of carbon dioxide (CO₂) in 2010. Furthermore, there have been additional supply-side incentives (e.g., accelerated depreciation, state and local incentives) and demand-side incentives for solar (e.g., renewable portfolio standards, solar carve-outs), which have added significantly to the total costs of emissions abatement from the collective solar incentives.

However, the costs of utility-scale solar projects declined by nearly 75 percent between 2010 and 2020, caused by economies of scale, learning effects, and advances in research and development. Consequently, a 30 percent investment tax credit for a 2020 solar project would have cost only $34 per ton of CO₂—less than the social cost of carbon used by the US Environmental Protection Agency and other government agencies. Electrolyzers may experience similar cost declines with increased production, which would allow future green hydrogen incentives to be far more economically efficient.

Decarbonizing Hydrogen Production by Supporting Blue Hydrogen

Although novel applications for hydrogen often receive a lot of attention, the use of hydrogen is already massive in scale, predominantly as a feedstock in oil refining and ammonia production. Outside of the hydrogen produced as a byproduct of petrochemical processes, the current US supply of hydrogen is from the carbon-intensive process of natural gas reforming, known as “gray” hydrogen. With 8.8 million metric tons of annual production and a CO₂ intensity of approximately 10 kilograms of CO₂ per kilogram of hydrogen, gray hydrogen accounts for nearly 1.7 percent of total US CO₂ emissions.

In contrast to clean hydrogen for use in novel applications, the costs and emissions requirements for clean hydrogen in existing applications are less demanding, for a few reasons. First, because hydrogen is required in these processes, no alternative decarbonization solution is available except for clean hydrogen. Second, compared to coal or natural gas, gray hydrogen is expensive; thus, clean hydrogen can compete more easily against gray hydrogen. Third, the GHG footprint of gray hydrogen is larger than that of natural gas; hydrogen that is cleaner than gray hydrogen but not completely free of emissions still may have substantial climate benefits. Given these considerations, “blue” hydrogen—produced by applying CCUS to natural gas reforming or coal gasification—offers a promising decarbonization option in the near term.

To achieve cost-effective climate benefits, an incentive for blue hydrogen must be sufficiently generous and well-designed—conditions that have not always been satisfied by proposed hydrogen policies. With only two operational blue hydrogen projects in the United States, costs are uncertain. However, recent publications from the International Energy Agency, the Columbia Center on Global Energy Policy, and McKinsey & Company estimate the cost of blue hydrogen with 90 percent CO₂ capture to be approximately $0.70 higher than the cost of gray hydrogen, per kilogram of hydrogen. While costs for blue hydrogen are expected to decline over time—particularly if autothermal reforming technology is adopted—developers would need a reasonable profit to compensate for project risks. Blue hydrogen projects are massive in scale, utilize new technologies, and require CO₂ infrastructure that may not yet be in place. Therefore, an incentive for blue hydrogen that is greater than $0.70 per kilogram of hydrogen by a reasonable margin is likely critical for enabling significant substitution of blue hydrogen for gray hydrogen.

To achieve cost-effective climate benefits, an incentive for blue hydrogen must be sufficiently generous and well-designed—conditions that have not always been satisfied by proposed hydrogen policies.

In addition to a sufficient credit level, an incentive for blue hydrogen also must be well-designed to achieve the cleanest possible blue hydrogen. As a recent study from Robert Howarth and Mark Jacobson emphasizes, blue hydrogen production emits more GHGs than just the CO₂ generated on-site. Most importantly, the leakage of methane (a potent GHG) in the natural gas supply chain, and emissions from the electricity generated to operate the CO₂ capture process, add to the total GHG footprint of blue hydrogen. These two additional emissions sources can be mitigated through the procurement of low-methane-emissions natural gas and zero-carbon power, respectively, but a blue hydrogen incentive must motivate developers to pay for these measures (which we have discussed in a previous blog post). An incentive based on life-cycle GHG emissions would minimize total emissions; an incentive based on the amount of CO₂ captured would not.

Cost-Effectiveness of Hydrogen Incentives and Production Pathways

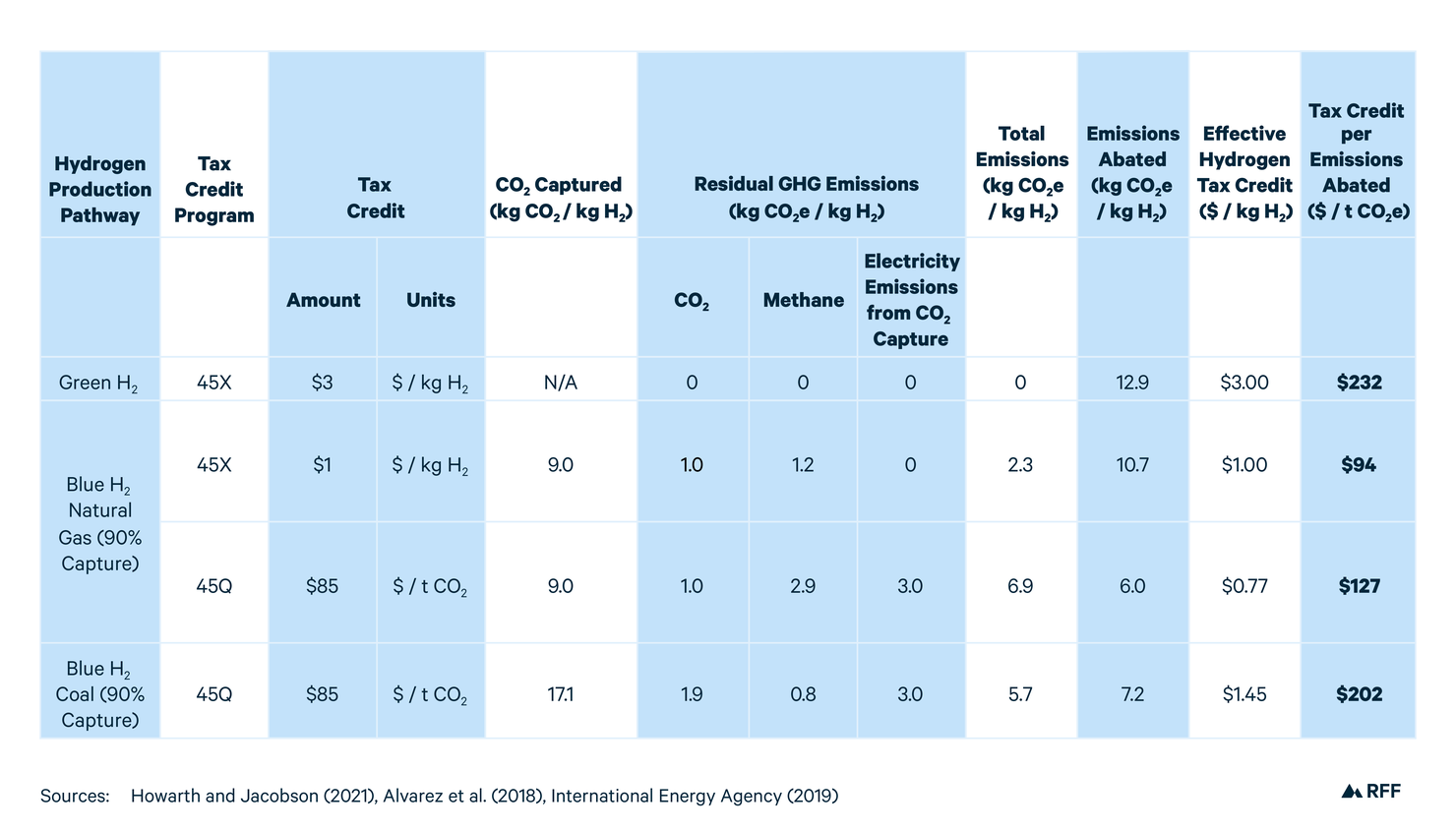

In Table 1, we calculate the costs of reducing emissions from gray hydrogen production through different hydrogen production pathways and tax credit programs in the October 28 draft of the Build Back Better Act. The first row shows the cost of emissions abatement for green hydrogen, using the $3-per-kilogram hydrogen incentive proposed in all recent versions of the 45X tax credit program for clean hydrogen production. Powered by renewable or nuclear energy, green hydrogen is assumed to have zero life-cycle emissions; displacing gray hydrogen with green hydrogen would eliminate all GHG emissions. However, the large credit needed to spur the development of green hydrogen means that the cost of carbon abatement is very high—about $230 per ton of CO₂ equivalent.

Table 1. Cost of Reducing Emissions by Replacing Gray Hydrogen through Different Policy Incentives and Production Pathways

IEA (2019) assumes on-site CO₂ emissions from gray and brown hydrogen of 10 kilograms of CO₂ per kilogram of hydrogen and 19 kilograms of CO₂ per kilogram of hydrogen, respectively. Alvarez et al. (2018) calculates an average methane leakage of 2.3 percent. Howarth and Jacobson (2021) calculate the methane emissions from coal. The global warming potential of methane over a 100-year time frame is 34. Low-emitting natural gas is assumed to have a leakage rate of 1 percent. CO₂ = carbon dioxide; CO₂e = carbon dioxide equivalent; H₂ = hydrogen gas; kg = kilograms; t = tons

The second row of Table 1 details the abatement cost of producing blue hydrogen from natural gas with 90 percent CO₂ capture, also through the 45X program. 45X tax credits depend on life-cycle GHG emissions, and, in the October 28 draft of the Build Back Better Act, one kilogram of hydrogen with emissions between 1.5 and 2.5 kilograms of CO₂ equivalent would receive a credit of $1. To attain this level of life-cycle emissions, a blue hydrogen project would need to procure low-emitting natural gas and zero-carbon power, resulting in life-cycle emissions of 2.3 kilograms of CO₂ equivalent and an abatement cost of $94 per ton of CO₂ equivalent.

The third row shows a blue hydrogen production pathway similar to that in the second row, but the incentive program is the proposed enhanced 45Q tax credit for CCUS, which would provide a credit of $85 per ton of CO₂ captured and sequestered. Because the credit is based solely on the amount of CO₂ captured, there is no incentive to mitigate methane or power-related emissions, and less than half of gray hydrogen emissions are abated. Although the credit is $85 per ton of CO₂, the additional emissions from electricity to run the carbon capture process offsets some of the emissions benefit and increases the cost of abatement to $127 per ton of CO₂ equivalent.

In the fourth row, the blue hydrogen comes from coal gasification rather than natural gas reforming. Although coal gasification does not happen in the United States at a meaningful scale, this “brown” hydrogen is a major global source of hydrogen, and an enhanced 45Q credit of $85 per ton could make blue hydrogen from coal an attractive proposition. With a high amount of on-site CO₂ emissions generated and captured, blue hydrogen from coal would receive $1.45 per kilogram. However, compared to a baseline of gray hydrogen, the reduction in emissions is only slightly greater than half, resulting in an abatement cost of over $200 per ton of CO₂ equivalent.

Current Policy Considerations

According to the data presented in Table 1, blue hydrogen projects under the 45X program would yield the most cost-effective emissions reductions. However, the effectiveness of 45X depends critically on the sufficiency of its credits. In the November 3 draft of the Back Better Act, the credit for hydrogen with emissions between 1.5 and 2.5 kilograms of CO₂ equivalent was cut to $0.75 per kilogram. Notably, this credit is just barely above the estimated additional cost of $0.70 per kilogram for the production of blue hydrogen with 90 percent CO₂ capture and is less than the credit for blue hydrogen under an enhanced 45Q. Consequently, blue hydrogen projects may not be viable under this latest version of the Build Back Better Act. If the incentives are worth it—and because the act would not allow blue hydrogen projects to get credits under both 45Q and 45X—then firms likely would choose the 45Q credit that incentivizes projects to maximize CO₂ capture rather than to minimize GHG emissions.

Although Table 1 also shows the high costs of emissions abatement for green hydrogen projects under 45X, the high costs are less concerning than they might initially appear. First, firms may have many reasons to prefer blue hydrogen over green hydrogen for oil refining and ammonia production, which would make the costly near-term substitution of gray hydrogen with green hydrogen less likely. Second, the high abatement costs for green hydrogen under 45X result from the high costs of this nascent production pathway—not from the inefficiencies or perverse incentives in policy design that exist for hydrogen production under 45Q. As was the case with solar energy production, high costs in the early stages of technology deployment can be warranted when the long-term potential is immense. Moreover, whereas solar power has benefited from an array of supply- and demand-side incentives, the only effective and large-scale driver of clean hydrogen is the 45X tax credit.

Hydrogen incentives can both support the development of technologies with great long-term promise and enable cost-effective reductions in hydrogen emissions in the near term. The 45X tax credit manages the former well. The latter also can be accomplished with the 45X tax credit—and not by 45Q—but only if the credits are sufficiently high.

Read more articles from the “Potential of Hydrogen for Decarbonization” blog series:

- “Evaluating Low-Carbon “Blue” Hydrogen Against End-Use CCUS” (January 11, 2021)

- “Evaluating Zero-Carbon “Green” Hydrogen Against Renewable and Nuclear Power” (January 20, 2021)

- “Reducing Emissions in Oil Refining and Ammonia Production” (February 4, 2021)

- “Reducing Emissions in Iron and Steel Production” (February 18, 2021)

- “The Right Policies Can Incentivize Cleaner “Blue” Hydrogen” (August 27, 2021)