A return on investment framework can help businesses identify the costs and benefits of participating in voluntary programs under the US Endangered Species Act that aim to encourage conservation by the private sector—beyond what is required for compliance.

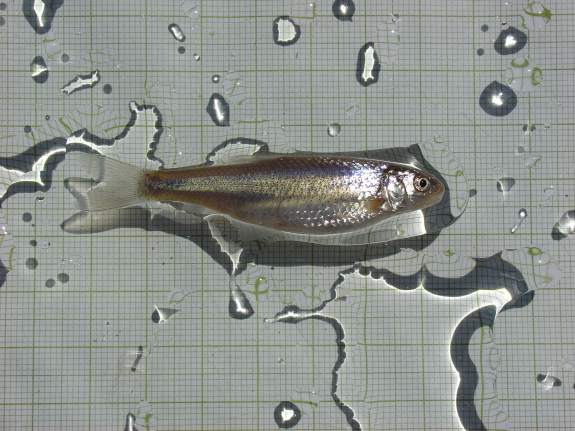

Preserving endangered species has implications well beyond the individual species’ viability into the future. The protection of species—from charismatic megafauna such as polar bears and sea turtles, to small invertebrates like crustaceans and corals, to plants including the American chestnut—matters not just as an end in itself, but also to broader ecosystem health and human well-being.

The US Endangered Species Act (ESA) protects imperiled species by prohibiting harm to listed species and their habitat. Over the last 20 years, the US Fish and Wildlife Service (FWS) and National Marine Fisheries Service have developed programs to increase management flexibility under the ESA and to encourage voluntary conservation actions by the private sector—above and beyond what is required for ESA compliance. Because two-thirds of all listed species are present on private lands in the United States, and one-third is present only on private lands, conservation investments by the private sector are critical to the long-term success of the ESA.

Conservation investments by the private sector are critical to the long-term success of the ESA.

Author

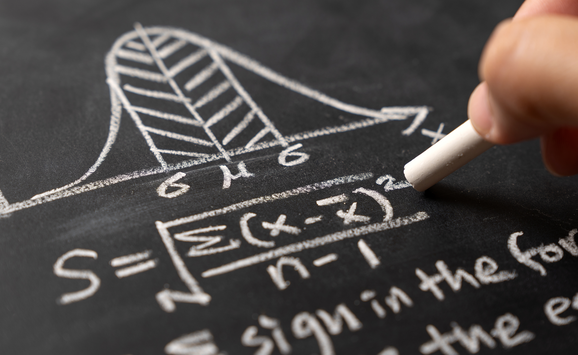

Why would private landowners and firms voluntarily engage in proactive conservation efforts? Businesses face a choice: to invest their time, money, and personnel in conservation associated with voluntary ESA programs, or not. How should that choice be analyzed? In recent research, we outline the available programs and how a return on investment (ROI) framework can be used by private sector conservation managers to inform decisionmaking about participation. ROI analysis is used to depict the scale and timing of an investment’s costs and benefits. Because ESA conservation program investments typically involve future costs and benefits, we employ a net present value framework, a conventional and widely used approach for assessing the profitability of an investment or project that accounts for the time value of money and discounts future costs and benefits relative to those in the present.

A Spectrum of Programs

A range of distinct voluntary programs exists under the ESA, including Candidate Conservation Agreements, Safe Harbor Agreements, the Working Lands for Wildlife Initiative, and a new Prelisting Conservation Policy, among others. Different programs are available in different contexts, depending on whether they target listed versus non-listed species, apply to public versus private lands, and seek to avoid harm to species versus create net conservation benefits. The programs also differ in terms of whether or not they provide regulatory assurances about future compliance requirements. Accordingly, participation incentives differ across the programs. Nevertheless, an ROI framework can be applied to each.

The Challenge of Quantifying and Defining Returns

For conventional business decisions, such as whether or not to develop a new product line, companies can relatively easily put a dollar value on the cost of investments (such as expected research and development, marketing, distribution, and training). The return on the investment is typically harder to estimate, but a variety of market data (current sales, consumer surveys, analysis of competitors, and so on) can be brought to bear to predict future revenues. Also, in a conventional business investment setting, costs and returns are denominated in the same terms: dollars. Costs and benefits estimated all in dollar terms allow an analyst to numerically apply the net present value formula and determine whether the investment yields a positive return (and thus is a good investment), or not.

Relative to a conventional business decision, analysis of private sector conservation returns is more difficult for two main reasons. First, not all conservation returns yield a direct, bottom-line change in a firm’s revenues or costs. Second, much of the data needed to quantify conservation returns are not conventional, market-oriented data. For example, conservation returns depend on factors such as ecological conditions and processes, land use and management by other private sector businesses, and legal issues. Quantifying these factors is difficult for scientific and legal experts, let alone a company’s own financial analysts.

In fact, the ability to boil down a conservation program investment to a dollars-and-cents calculation should be viewed with skepticism. Readers should not expect an easy-to-collect data checklist and “turn the crank” formula for calculating conservation ROI. Rather, we show how an ROI framework may be applied by private sector conservation managers to clarify their judgments about whether conservation investments are in the interest of a firm and provide guidance on the kinds of quantifiable analysis and the information needed to give such analysis more certainty. We also describe how the relevant returns and costs differ across ESA programs and environmental and business conditions.

Core Elements of Conservation ROI Analysis

The core elements of conservation ROI analysis include the costs of conservation, identification of the returns to be considered, the impact of conservation actions on those future returns, and expected returns if conservation does not occur (baseline returns). How discounting and uncertainty affect current and future costs and benefits is also fundamentally important.

Discounting implies a reduction in the value of benefits (or costs) that arise in the future—one dollar in the future is worth substantially less than that same dollar today. Thus, the timing of investments, compliance requirements, and benefits is financially important. Consider a conservation investment made in anticipation of a species being listed. The further in the future that listing is expected to occur, the less private sector motivation there is to invest now, all else equal. In general, the greater the delay between a conservation investment and its future compliance-related benefits, the lower the return on investment—purely due to the effects of discounting.

Uncertainty about the cost of future ESA-imposed requirements complicates matters. Will a species be listed? If so, what restrictions might be placed on businesses? Some conservation programs act as a kind of hedge against this type of uncertainty, by formally clarifying which land uses and other resource management actions will be allowable in the future. The ability to reduce such uncertainty is valuable—in general, risk reduction benefits a firm by lowering its capital costs. Another virtue of legal clarification (a product of some of these conservation programs) is that it can help reduce future permitting delays and thereby speed firm actions otherwise slowed by an ESA regulatory process.

The Cost of Conservation

Participation in conservation programs always requires an investment of some kind. “Direct” (out-of-pocket) costs can include capital and labor investments in vegetation management, habitat restoration, restocking, fencing, and monitoring, for example, as well as legal and administrative costs associated with agreement development. In some cases, technical or funding assistance may be available from the FWS or interested nongovernmental organizations (NGOs) to help offset some of these direct costs. “Indirect” costs can take the form of habitat and species protections that prohibit the firm from taking future actions beneficial to it (such as using lands for commercial purposes inconsistent with conservation requirements under the ESA). In economic parlance, these are “opportunity” costs borne by the firm.

Returns to Be Considered

As noted, ROI returns are conventionally defined as the dollars earned as a result of an investment; these can refer to either revenue generated or costs saved by the investment. Conservation program participants can “earn dollars” in both ways. Bottom-line returns to the private sector from investments in voluntary conservation programs generally fall into two categories: avoided compliance costs and reputation (or corporate social responsibility) benefits. In principle, both types of returns can be quantified and expressed in dollar terms—but doing so can be challenging in practice.

Protecting species matters not just as an end itself, but also to ecosystem health and human well-being.

Author

First, and perhaps the most important, are returns that result from a reduction in current or future ESA compliance costs that result from delays, restrictions, and uncertainty posed by permitting requirements. Some conservation programs, such as Habitat Conservation Plans, provide returns by enabling economic activities to move forward that otherwise would be prohibited under the ESA. Other programs, such as Candidate Conservation Agreements with Assurances, secure permitting for economic activities in advance of a species listing, thereby avoiding delays in profit streams and also reducing uncertainty. Conservation ROI analysis requires an assessment of how a firm’s compliance costs—current and future—will change as a result of participation.

Being perceived as a proactive conservation steward can also benefit businesses. Experience with corporate social responsibility initiatives suggests that some firms can secure bottom-line benefits (via consumer marketing and employee hiring and retention advantages) from being perceived as an environmental leader—which may be the case because of a firm’s participation in ESA programs. Accounting for marketing and human resource benefits may therefore be important for conservation ROI analysis. Some landowners may also pursue conservation for other—ethical or moral—reasons, which we do not include in our “bottom-line” perspective on returns, as these motivations are not financial, by definition.

Finally, we note that a firm’s conservation actions can also yield social benefits (in addition to the benefits to threatened and endangered species explicitly targeted by the program agreement)—in the form of “ecosystem services” benefits. For example, habitat restoration can also improve aesthetics, recreational features, downstream water quality, and flood protection. Some of these benefits may accrue directly to the firm (flood protection, for example), but most typically benefit the public more generally and are not captured by businesses. While we are proponents of ecosystem benefits analysis for public decisions, these public benefits generally are not pertinent to a firm’s bottom-line conservation ROI analysis—with one caveat. Firms that can demonstrate public benefits from their conservation investments can use that information as part of their corporate social responsibility strategies.

At a Glance: Private Sector Conservation under Voluntary ESA Programs

- Participation in voluntary conservation programs under the ESA can trigger a range of immediate and longer-term costs for businesses. But proactive, voluntary conservation can be in the private sector’s interest, particularly when it reduces the probability or cost of future compliance obligations.

- Participation in these programs can also reduce business uncertainties and risks and may help avoid regulation-driven delays to new land uses or other investments.

- Analysis of participation incentives is relevant to NGOs and other conservation advocates interested in encouraging more conservation by the private sector.

Future and Baseline Returns

Because both business and ecological conditions typically change over time, analysis of future conditions is important to ROI analysis. For example, in order to determine the compliance costs avoided by conservation investments, it also is necessary to predict what compliance costs would be without conservation (that is, baseline conditions). In part, that is a function of expectations regarding the future state of species and their habitats (on an owner’s property and beyond). Additionally, when businesses weigh the opportunity costs of putting conservation restrictions in place today, they need to consider how those restrictions might affect their ability to respond to changing business conditions.

Prospects for Conservation ROI Analysis

Is fully quantitative conservation ROI analysis realistic? An overarching point is that while all of the costs, uncertainties, and benefits described above could be converted into monetary terms, doing so is very difficult. Firms can (and should) engage in ROI thinking about conservation programs, but should not expect to fill out a spreadsheet easily with monetary estimates of costs and benefits.

Direct and Indirect Costs

The direct costs of conservation are an obvious exception—investments in engineering, labor, construction, and operations are relatively easy to quantify because restoration activity is widespread across the private sector, NGOs, and the government, with abundant data. These reflect costs that are more or less “tangible” and consistently collected in monetary terms.

In contrast, the indirect costs associated with participation in a voluntary conservation program are more speculative and idiosyncratic to specific firms, their operations, and locations. If a firm agrees to conserve a parcel of land, it cannot develop the land now or in the future, even if it is privately beneficial to do so. Those foregone benefits are a cost to participation. But how large is that cost? That depends on a range of factors related to the firm’s specific business opportunities and how those opportunities are likely to change over time, given changing markets and technology. Conservation of a parcel that is highly unlikely to be commercially valuable has a relatively low opportunity cost; the opposite is true of a parcel that is highly likely to be commercially valuable. Such rough judgments can be made, short of the ability to monetize them.

To estimate costs, firms must understand what specific requirements exist for participation in a program. This typically means that a firm must invest in engagement with the FWS or state wildlife agencies in order to explore specific options and estimate costs and benefits. But there are exceptions—for example, when a programmatic agreement is already in place, in which the firm can participate. These agreements are in a sense pre-negotiated and pre-specified, making it easier and cheaper for firms to assess the pros and cons of participation.

Compliance-Based Returns

Quantifying compliance-based returns is complicated by legal and regulatory uncertainties, as well as the specific characteristics of the firm and its land and water resources. For example, when considering conservation investments for a non-listed species, a firm must consider what the probability of listing is for that species, and what regulatory requirements will emerge if the species is listed. To get a sense of the probability and timing of potential future listings, firms may start by consulting the FWS Listing Workplan. Firms can also consult Federal Register documents as a source of information on the status of and threats to species. Regular communication with state or regional FWS offices, as well as state wildlife agencies, also can help firms estimate the timing and likelihood of future listings.

Even if it was known with certainty that a given species was to be listed in five years, a firm would need to conduct analysis of its lands and operations to determine if it will be subject to regulatory constraints or if its lands and operations provide opportunities for voluntary, beyond-compliance conservation. The FWS’s Information for Planning and Consultation (IPaC) tool as well as State Wildlife Action Plans or other state conservation strategies can provide useful guidance on both the type and the location of conservation actions most beneficial to particular species and likely regulatory restrictions.

In order to understand the upside of participation—the returns—firms must also understand the assurances and other advantages possible under a voluntary program. For example, some voluntary programs can reduce legal and operational risks by providing assurances that no additional actions will be required of them in the future, beyond those specified in an agreement. Businesses may incorporate this value of reduced risk and uncertainty into their monetary estimate of returns. Our study outlines the types of returns likely under each program and factors that may affect their magnitude—but engagement with the FWS may be necessary to understand the extent and details of a program’s particular benefits to a firm. Again, this highlights an advantage of participating in an existing programmatic agreement.

Business Reputation Advantages

Businesses routinely engage in environmentally beneficial behaviors that are not motivated directly by statutes or regulations and that go beyond compliance. But while voluntary, these actions should usually not be considered altruistic—the motivation often remains profit maximization. So, apart from compliance-related, bottom-line benefits, will participation in proactive conservation yield bottom-line reputational and marketing benefits? In principle, corporate social responsibility and reputation enhancements could have a bottom-line value that can be expressed in dollar terms. Our guess, however, is that most firms take a more qualitative approach to weighting reputational factors.

Concluding Thoughts

Our research emphasizes the “business case” for voluntary conservation and is geared toward a private sector audience. But because private conservation incentives also serve public goals, they are also of interest to the FWS and other conservation advocates. The trade-offs and information needs identified in our analysis can help guide the design and implementation of voluntary programs to stimulate more private sector species protection.