As the first cap-and-trade program in North America, RGGI has had an outsized influence on the design of similar programs worldwide. RGGI now plans to implement an innovative new mechanism to help reduce price volatility in the allowance market.

Since its inception in 2009, the Regional Greenhouse Gas Initiative (RGGI) has been an innovator in the design of climate policy. RGGI is a market-based program that sets a cap on carbon dioxide (CO2) emissions from the electricity sector in nine northeastern states and allows trading of emissions allowances in order to achieve compliance at the least possible cost. The state coalition is now about to conclude its second periodic Program Review. RGGI is poised to lead the way once again with recently announced additional cuts in greenhouse gas emissions and important changes to the system’s design. In particular, RGGI plans to introduce a new mechanism—an emissions containment reserve (ECR)—to improve the performance of the market for allowances.

From the outset of RGGI, the price of emissions allowances has proven to be lower than most observers expected. The quarterly auction of allowances has often cleared at or near the lowest possible price allowed by the program’s design, the price floor (also known as the “auction reserve price”). We explored the idea of an ECR mechanism to address this issue, and described this research and analysis in a series of public webinars for RGGI stakeholders last winter and spring. In an RFF report out last month, we detail our results and findings and show how an ECR would incorporate a minimum price for specified quantities of allowances under the emissions cap, thereby introducing one or multiple steps into the allowance supply function.

The ECR mechanism would enhance the existing market and support the allowance price by making the supply of allowances responsive to the market price, in the same way most commodity markets work. For example, when the price of natural gas falls, one expects to see a reduction in drilling activity, resulting in less natural gas coming into the market. This interaction between demand and supply helps reduce price volatility, and the adjustment in supply helps the market to achieve an equilibrium price.

Unexpectedly low allowance prices do not provide the incentives to transform the energy sector.

Previously, during RGGI’s first Program Review, the excess supply of allowances was addressed by adjusting the emissions cap, which led to an increase in the price of allowances from 2013 through 2015. Since then, however, prices have been declining and they are again near the price floor. There is a recognition that compliance costs and allowance prices may again eventually settle at levels that are lower than expected, which has been a common experience across most cap-and-trade programs.

Low prices suggest low costs for industry and consumers, which is a good thing. But unexpectedly and persistently low allowance prices do not provide the incentives for the investments necessary to transform the energy sector, including investments in renewable energy and energy efficiency. In the new report, we describe the results of our simulation modeling and laboratory experiments to analyze the potential introduction of an ECR to RGGI, and give a brief overview here of how the ECR will help stabilize the performance of the market for allowances going forward.

What Is an Emissions Containment Reserve (ECR)?

An ECR mechanism supports the market for emissions allowances by reducing the number of allowances that are sold at low prices. Implementation of an ECR would not replace the price floor, which applies to all allowances and ensures that none are sold below the reserve price. An ECR functions in addition to the price floor—specifying a minimum price (above the price floor) that would apply to only a set portion of the allowances offered at auction.

The mechanism is simple. If the demand for allowances is low, the auction clearing price will fall. If the auction price falls to the minimum prescribed by the ECR, then some or all of the set amount of allowances associated with the ECR would not be sold—and the allowance price would respond to the reduced supply accordingly. An ECR could be designed to have multiple price “steps,” each associated with a different set of allowances.

How Does an ECR Affect the Allowance Market?

Our analysis indicates that an ECR supports allowance prices when allowance demand is lower than anticipated. In both the simulation modeling and laboratory experiments, we did not identify any ways that an ECR might not work as expected.

We simulated and examined scenarios with low allowance demand resulting from expanded availability of hydro and other renewable energy sources, nuclear power, low electricity demand, and changes in fuel prices. Under RGGI currently, the allowance price has to fall all the way to the price floor before low allowance demand results in any additional reduction in emissions.

An ECR leads to sharing the benefits of lower-than-expected compliance costs among economic & enviromental interests.

Author

In contrast, an ECR leads to a sharing of the benefits of lower-than-expected compliance costs among economic and environmental interests. A lower allowance price benefits the economy and fewer emissions benefit environmental goals.

Low allowance demand might be the result of reduced electricity demand due to technological improvements, state and local government policies to support CO2 reduction goals, and other market factors. By sharing the benefits of low allowance demand among economic and environmental interests, an ECR supports climate change mitigation efforts by state and local governments, companies, and individuals.

Our assessment of the ECR mechanism demonstrates that the supply adjustment mentioned above helps reduce price volatility. Laboratory experiments also show that an ECR is easy for market participants to understand and does not interfere with the performance of the allowance auction.

Transparency is enhanced by an ECR, which establishes a predictable and timely system for withholding allowances from auction—instead of waiting for a future program review to determine an adjustment to account for lower-than-expected compliance costs.

A large bank of accumulated allowances motivated adjustments in RGGI’s 2012 Program Review and is of concern again now. By reducing the supply of allowances, an ECR might be expected to reduce the banking of allowances. However, our research provides mixed results regarding the effect of an ECR mechanism on banking. Simulation modeling suggests that if the ECR is going to be triggered in a future year, compliance entities might acquire allowances in the near term for later use. In practice, though, future market outcomes are hard to predict—and the laboratory market experiments with human subjects show that an ECR would reduce the amount of banking that occurs.

We identified various benefits associated with an ECR mechanism and have not found a potential downside. If the price of allowances does not fall below expected levels, an ECR would have no effect; if it does, an ECR can help support the program by reducing the sale of allowances at low prices.

How Is an ECR Implemented?

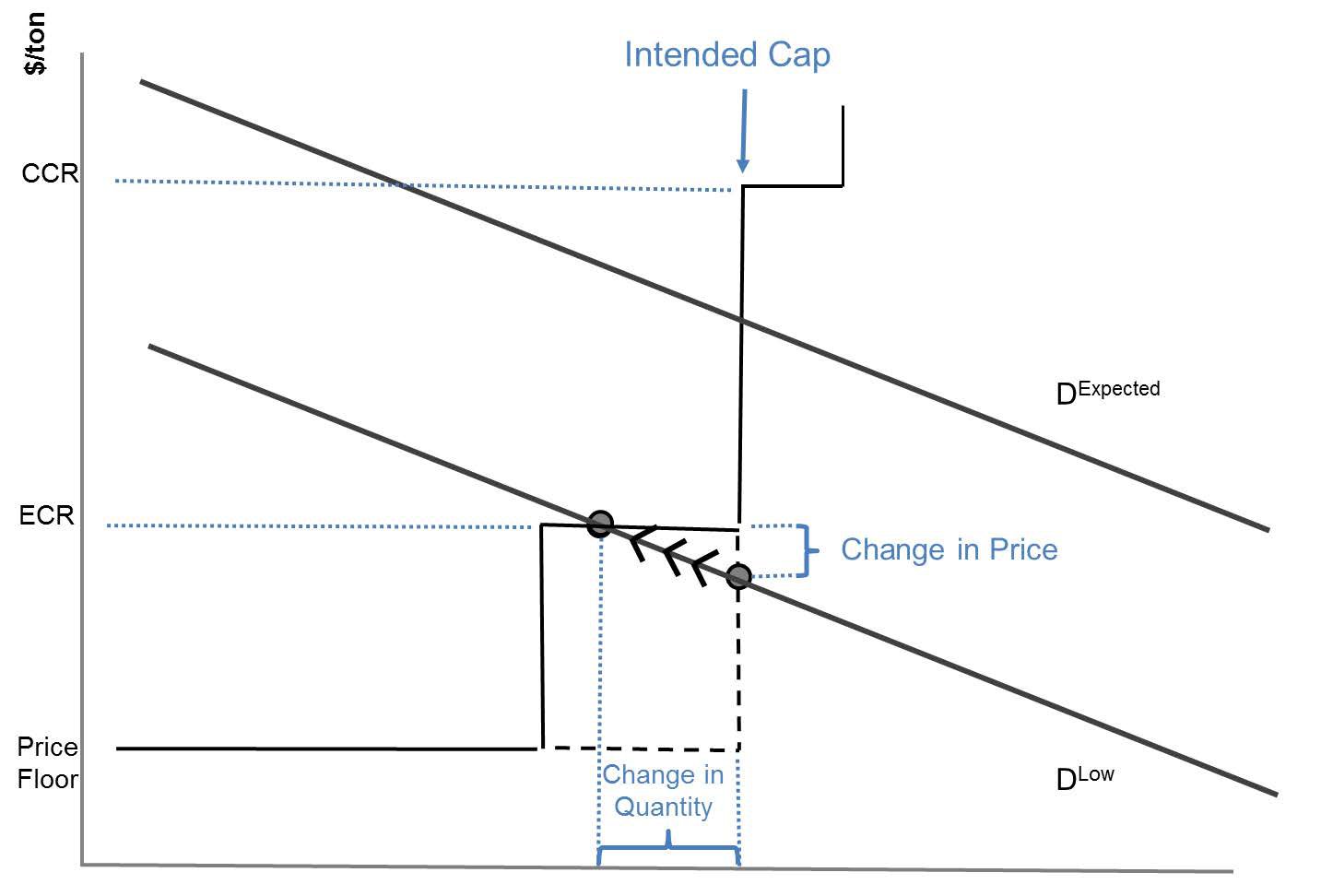

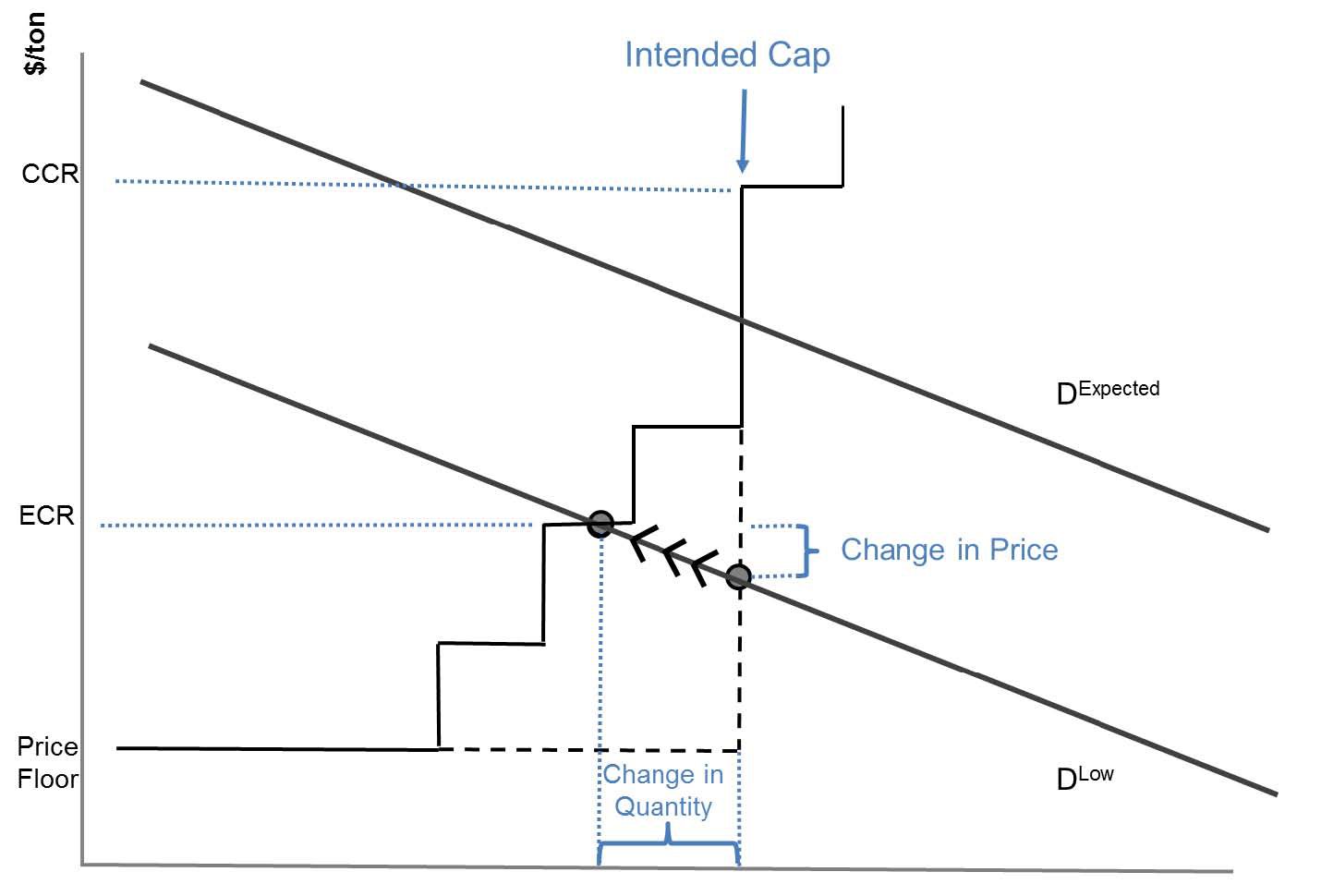

The RGGI states need to make only two design decisions to implement an ECR. One is the number of price steps and the quantity of allowances associated with each step. We explored a one-step ECR (Figure 1), a multiple-step ECR (Figure 2), and a continuous ECR ramp. The second decision is the price level of the ECR step or steps, and we investigated several alternatives. RGGI’s proposal pulls from among these options by introducing a single-step ECR at a price level of $6 per ton beginning in 2021—this is associated with about 10 percent of the allowances under the emissions cap.

Figure 1. An Illustration of an ECR with One Step and Changes that Result from a Low Demand for Emissions Allowances

Figure 2. An Illustration of an ECR with Multiple Steps and Changes that Result from a Low Demand for Emissions Allowances

An ECR mechanism is implemented in an identical (although independent) way as its counterpart—the cost containment reserve, which applies when prices are higher than expected. A cost containment reserve makes available a quantity of allowances at or above a prescribed price, thereby sharing the risk of higher-than-expected costs among economic and environmental interests. An ECR shares the benefits of lower-than-expected costs by reducing the allowance supply when the allowance price falls to a predetermined level.

What Are the Benefits of an ECR for RGGI?

An ECR will provide important benefits to improve functioning of RGGI’s market for emissions allowances.

Author

Our findings indicate that an ECR mechanism will provide several important benefits to help improve the functioning of the market for emissions allowances under RGGI:

- Shares risk and benefits from changes in market demand. The mechanism shares the risks and benefits of changes in the demand for emissions allowances among economic and environmental interests.

Preserves incentives for other action on climate change. An ECR helps preserve incentives for state and local government action and individual efforts to address climate change goals by enabling additional emissions reductions when prices are low.

- Reduces price volatility. An ECR is transparent and can be expected to reduce price volatility, providing a more predictable market environment, which should promote investment.

- Facilitates an easier process for program reviews. An ECR will not eclipse the importance of regular RGGI program reviews, but it may make those reviews significantly easier to accomplish.

As the first cap-and-trade program in North America, RGGI has had an outsized influence on the design of similar programs around the world. Those design changes have been incremental, building on previous success. The implementation of an ECR mechanism holds the potential to be the next big evolution in carbon markets.