September 25, 2018, marks ten years since the Regional Greenhouse Gas Initiative (RGGI) held its first auction. RGGI was the first mandatory carbon cap-and-trade program in North America. The Initiative introduced an emissions limit for electricity generators within a nine-state region, with a compliance obligation beginning in 2009.

The RGGI program was initially and has remained bipartisan. It was sparked by New York Republican Governor Pataki and has witnessed Democratic and Republican governors in all the participating states except Delaware (which has been Democratic throughout) and New Jersey (which left the program when Republican Governor Christie took office). And, although the program is modest in reach and in stringency, it can claim substantial emissions reductions and has had an outsized influence on carbon policy internationally.

One significant influence stems from the introduction of an allowance auction. To help utilities prepare for compliance in 2009 and to gain a better understanding of what allowances would cost, the states held their first auction a few months prior to the beginning of the first compliance period. Prior to RGGI, emissions cap-and-trade programs including the sulfur dioxide trading program created under Title IV of the 1990 Clean Air Act Amendments and the seasonal nitrogen oxides budget trading program in the eastern US predominantly distributed allowances for free.

The RGGI states chose instead to auction allowances, and that model has since propagated to all major carbon trading programs. RGGI adopted an auction to distribute allowances for three important reasons.

First, electricity sector restructuring and the move to competitive markets replacing traditional cost-of-service regulation as the price setting mechanism for electricity generation negated the cost savings to electricity consumers from free allocation. In 1990, when the sulfur dioxide market was envisioned, nearly all the affected electricity generators were owned by regulated utilities where states set prices based on average cost. When these generators received allowances for free, they would pass the benefits of the free allowances on to electricity consumers. However, generators that operate in competitive markets would roll the full opportunity cost of free allowances into electricity prices in recognition that instead of using that allowance, they could sell it and make money. Thus, giving allowances away for free could lead to higher electricity prices and windfall profits to electricity generators, something that was already apparent in the EU ETS.

Second, auctioning of allowances would yield revenues that could be used for other purposes. The RGGI Memorandum of Understanding allows flexibility to states in how to initially distribute allowances, provided at least 25 percent of the allocations go to a consumer benefit or strategic energy purpose. Because generators in the region were no longer regulated, the only way to ensure that benefits were distributed appropriately was to auction at least this share of allowances. In practice, virtually all the allowances are auctioned now. Roughly two-thirds of the $3 billion in auction revenue to date has been invested in energy efficiency programs, which has reduced electricity consumption yielding consumer savings. Substantial funds have also gone to clean energy programs and bill assistance.

Third, the allowance auction aided in price revelation. Prior to the auction there was considerable uncertainty about what the price of an allowance might be, as well as whether all compliance entities would have fair access to buy allowances. Researchers at RFF and the University of Virginia suggested an auction design that included a minimum auction price (also known as a reserve price). The minimum auction price functions just like a minimum acceptable bid in eBay—allowances won’t be sold below that price. During periods when demand has been soft, the auction price has fallen to the price floor and not all allowances have been sold, thereby constricting supply and supporting the market. The auction price floor has been important in providing buoyancy at times of low allowance demand between regular program reviews when states have adjusted the cap. At these times, the minimum price boosted confidence that clean energy investments would have enduring economic value, and strengthened overall confidence in the longevity of the program.

After RGGI’s decision to auction, the EU ETS decided to also do so for their electricity sector. The economy-wide trading programs in California and Quebec also decided to auction most of their allowances and adopted the minimum auction price feature as well.

RGGI has continued to innovate. For example, it has provided cost containment by making supplemental allowances available if prices exceeded specified levels. RGGI has used its periodic program reviews to reduce the number of allowances in the auction when the surplus of allowances has grown to be large. And, it has introduced a new feature called the “emissions containment reserve” that associates a second, higher minimum price on a subset of allowances. Combined with the overall price floor, this feature effectively creates a series of minimum prices at which various quantities of allowances can be purchased in the auction. If allowance prices fall unexpectedly in the future, allowance supply will automatically and incrementally adjust just as happens in commodity markets, resulting in additional emissions reductions.

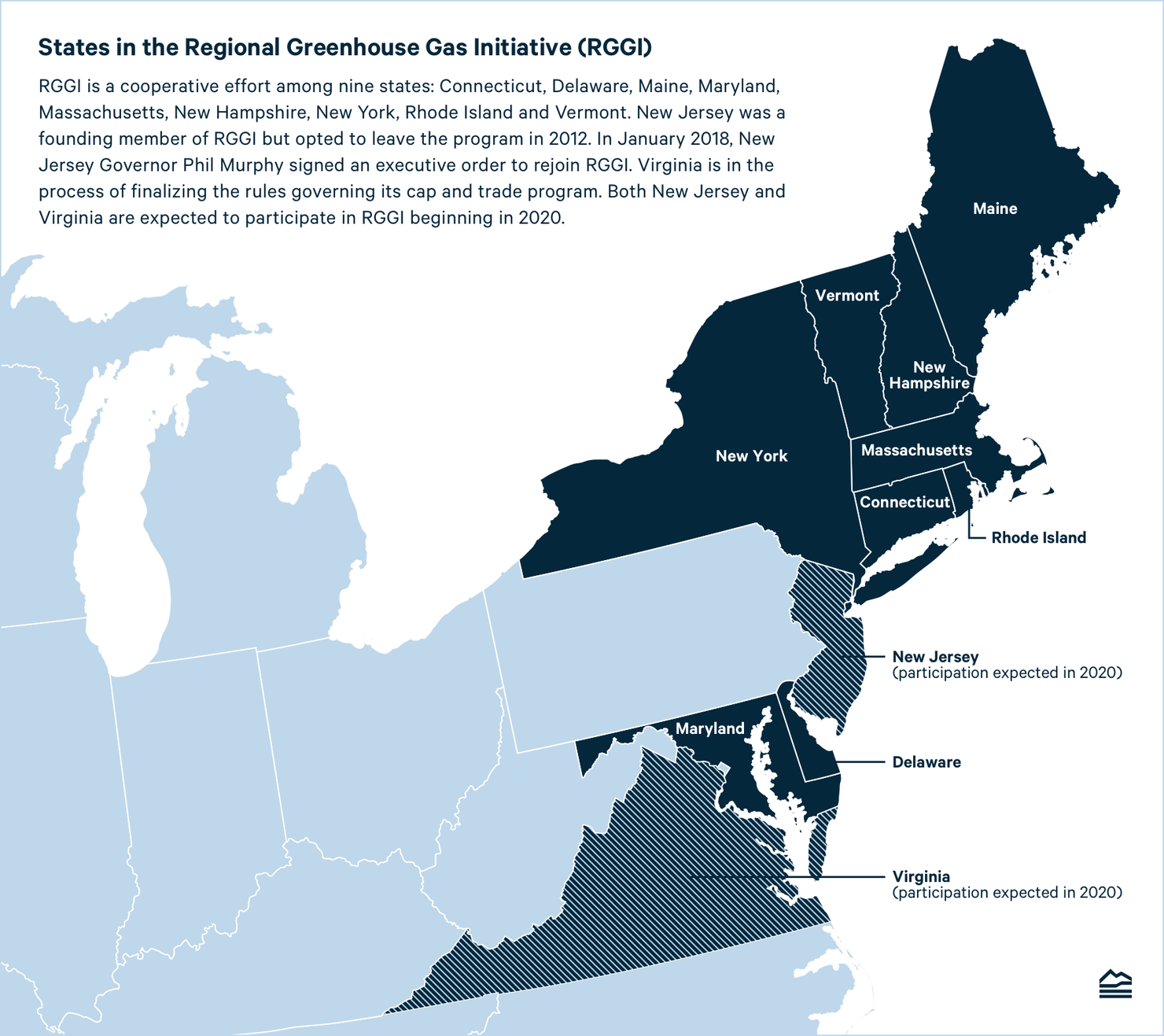

In 2020, New Jersey and Virginia are expected to link with RGGI. Virginia will have the greatest emissions of any single state, but unlike most other states in RGGI it does not have a competitive electricity market. Consequently, Virginia will distribute allowances for free to generators and require the allowances be consigned (sold) in the auction, receiving revenue in turn. Because electricity generation in Virginia is regulated, the auction revenue is expected to accrue to the benefit of consumers.

The first RGGI auction ten years ago initiated the introduction of a carbon price on a regional basis, linking multiple jurisdictions to address the global problem of climate change. The region can celebrate the durability and success of the trading program. As importantly, the program has offered a model that has influenced other cap-and-trade programs around the world.