The primary existing policies and policy options for reducing emissions from the transportation sector include renewable fuel standards and low-carbon fuel standards, programs that promote the use of alternative-fuel vehicles, and more.

The transportation sector—which includes economic activity from all forms of travel—is the largest source of greenhouse gas (GHG) emissions nationally, accounting for 29 percent of the total GHG emissions in the United States in 2019.

Over the past 30 years, emissions from the transportation sector have grown by about 24 percent. Most modes of transportation depend heavily on fossil fuels for energy: passenger vehicles largely burn gasoline, delivery trucks typically use diesel fuel, and aircraft rely exclusively on jet fuel. Each of these fuels is derived from crude oil, causing the transportation sector to be a large source of GHG emissions.

Policymakers have developed a series of major federal regulations for reducing transportation emissions. Instead of relying on a single climate policy, such as a carbon price, the United States has a patchwork of emissions regulations in the transportation sector. This article reviews current policies and policy options for emissions reductions in the sector, including fuel economy and GHG standards, programs to promote the use of alternative-fuel vehicles, GHG standards for airplanes, and renewable and low-carbon fuel standards.

The future trajectory of transportation emissions is uncertain. Prior to the COVID-19 pandemic, transportation sector emissions were expected to grow, primarily due to expected increases in vehicle travel, especially heavy-duty vehicles. But as the economy recovers from the pandemic, it’s hardly a given that households and businesses will revert to past behavior. Anticipated innovation, such as automated driving, creates additional uncertainty about future transportation demand.

Decarbonizing transportation requires burning less fuel derived from crude oil, which can be achieved by reducing either the number of miles driven (vehicle miles traveled, or VMT) or the amount of fuel used per mile traveled. In the 50 years prior to the COVID-19 pandemic, VMT increased dramatically as growing median household income increased demand for travel, goods, and services. Policies that raise the per-mile cost of driving, such as gasoline tax hikes, tend to have little effect on reducing VMT because driving is a necessity for many households; as a result, the demand for VMT is generally price inelastic, which means that changes in the cost of travel do not greatly affect demand.

Because reducing VMT through policy is difficult, transportation sector decarbonization efforts have largely focused on reducing the amount of fuel used per unit of VMT. Technology is currently available for reducing the amount of fossil fuel per unit of VMT—in particular, by adding fuel-saving technology to gasoline engines or by adopting battery electric vehicles. These technological innovations have provided a wide variety of avenues for companies to achieve regulatory goals. According to the US Environmental Protection Agency (EPA), carbon dioxide emissions have decreased 23 percent, and fuel economy has increased by 29 percent, or 5.6 miles per gallon, since 2004. But expanding the technology throughout the transportation sector presents challenges, because cars, trucks, airplanes, and ships last for a long time and can take decades to be replaced by new, more fuel-efficient vehicles.

While a carbon pricing program is known to be a cost-effective method for reducing GHG emissions, this policy option may not be politically viable at the scale needed to decarbonize the transportation sector. A carbon price may be effective at reducing emissions in other sectors; however, reductions in transportation emissions due to a carbon price are likely to be smaller than those due to the policy options outlined below.

Fuel Economy and Greenhouse Gas Standards

The Basics

Fuel economy and GHG standards can be used to reduce emissions from light-, medium-, and heavy-duty vehicles, which collectively emit more than 80 percent of all GHG emissions from the transportation sector (Figure 1). Fuel economy standards require manufacturers to achieve a minimum average miles per gallon for the vehicles they sell, and GHG standards require reductions in average vehicle lifetime emissions below a certain limit. The two sets of standards essentially regulate the same thing. By directly increasing fuel economy and reducing GHG emissions from new vehicles, these standards reduce fuel use per mile traveled.

Benefits

- Fuel economy and GHG standards reduce the amount of fuel that’s required to travel a set distance.

- Standards do not require a reduction in travel.

- Standards save consumers money, as drivers tend to spend less money on gas for each mile traveled.

- Fuel economy standards have garnered support from both consumers and policymakers, making this policy option politically viable.

Challenges

- Fuel economy and GHG standards create a rebound effect for light-, medium-, and heavy-duty vehicles alike: some vehicle owners decide to drive their vehicles more as their vehicles get better fuel economy, which increases emissions.

- Standards are expected to increase the price of new vehicles, prompting potential car buyers to hold on to their used, less fuel-efficient cars for longer. This prolonged use delays the scrappage of older, fuel-inefficient vehicles, which erodes intended GHG reductions.

- Standards generally are a less efficient way to reduce transportation emissions compared to a carbon price, because of the downsides detailed above.

Key Considerations

- Designing effective and economically efficient fuel economy and GHG standards requires providing vehicle manufacturers with as much flexibility as possible. Currently, the standards allow manufacturers to earn, buy, and sell credits to each other, similar to an emissions trading program, which has likely reduced the cost to comply with the standards. However, the prices of credit transactions are not currently reported, which could make credit trading more difficult for companies and could hinder investments in fuel-saving technology.

- Overlap between the fuel economy and GHG standards for light-duty vehicles. These standards effectively regulate the same thing, but they have several key differences that make it difficult for manufacturers to comply with both cost-effectively. Cost-effectiveness can be improved by reducing or eliminating discrepancies, or more radically, by eliminating one of the programs—most likely the fuel economy program.

Past, Current, and Proposed Policies for Fuel Economy and GHG Standards

Corporate average fuel economy and GHG standards currently are in place to regulate and reduce emissions from passenger vehicles, while separate standards are used for medium and heavy-duty vehicles. Cars, being lighter weight, traditionally have higher fuel economy standards and lower GHG standards than those that apply to trucks.

In 2020, the Trump administration replaced the 2021–2025 Obama standards with the Safer Affordable Fuel-Efficient (SAFE) Vehicles Rule. The Biden administration plans to review the Trump administration’s rollback with an executive order.

Programs that Promote Alternative-Fuel Vehicles

The Basics

The US transportation sector currently is shifting away from relying on fossil fuels to using electricity. Alternative-fuel vehicles—including electric vehicles and hydrogen fuel cell vehicles—are at the forefront of this transition. Federal and state policies currently promote the adoption of electric and hydrogen fuel cell vehicles, including federal income tax credits and Zero Emission Vehicle programs.

Federal Income Tax Credits for Plug-in Hybrid and Electric Vehicles: Because they do not produce tailpipe emissions, electric vehicles (EVs) could completely decarbonize passenger vehicle travel. For this reason, the United States currently subsidizes the purchase of EVs through a federal income tax credit.

Zero Emission Vehicle Programs: Zero Emission Vehicle (ZEV) programs require automakers to sell a certain number of electric and fuel cell vehicles, typically determined as a fraction of total vehicle sales. These key policies aim to increase the market share of EVs in select states.

Benefits

- Tax credits increase EV sales by reducing the effective sales price of EVs and plug-in hybrids, which displaces sales of gasoline vehicles.

- ZEV programs (which target automakers) increase the number of alternative-fuel vehicles sold, which leads to emissions reductions—if these vehicles replace higher-emitting vehicles on the road.

- In areas of the country with a relatively clean electricity grid, an increase in EV sales reduces GHG emissions. As the power sector decarbonizes, this benefit will be amplified.

- ZEV programs allow manufacturers to meet regulatory goals on their own terms, through credit trading and other flexible compliance measures. Arguably, this flexibility could increase market competitiveness and decrease overall EV prices.

Challenges

- An increase in the number of EVs could increase emissions through the production of electricity, even as vehicle emissions fall. Therefore, using clean sources for electricity production will be a vital part of reducing emissions.

- The tax credits are regressive—the federal tax credit currently applies only to the purchase of new EVs, which tend to be bought by relatively wealthy households.

- EV tax credits compensate some households for EV purchases that they would have made anyway, reducing the impact of the tax credit. One countermeasure could be to create a rebate rather than a tax credit, which is considered more equitable and would decrease the overall price of an EV at the point of sale.

- While ZEV programs do not directly affect used vehicles, households are likely to respond to higher-priced ZEVs by holding on to their used vehicles for longer. The used vehicle fleet takes decades to turn over, which will delay the impact of new ZEVs on fleet-wide vehicle emissions.

Key Considerations

- Tax credits for hybrid vehicles and EVs could be redesigned as a more cost-effective and equitable strategy for increasing EV adoption. The current design of the tax credit tends to favor high-income buyers, who are more likely to be able to claim the full tax credit. An alternative design of the credit could follow California’s Clean Vehicle Rebate Project, which offers a direct rebate instead of a tax credit and limits eligibility based on household income. This strategy could help attract lower-income households, likely leading to an increase in “additional” EV sales—sales that would not have occurred had the subsidy not been available—and increase the number of EV sales sold per dollar spent under the program.

- The uncertainty of technological innovation and future costs when designing ZEV programs.

- The benefit of clear information on credit prices when designing ZEV programs.

- The need for flexibility and consistency when designing ZEV programs.

Past, Current, and Proposed Alternative-Fuel Vehicle Programs

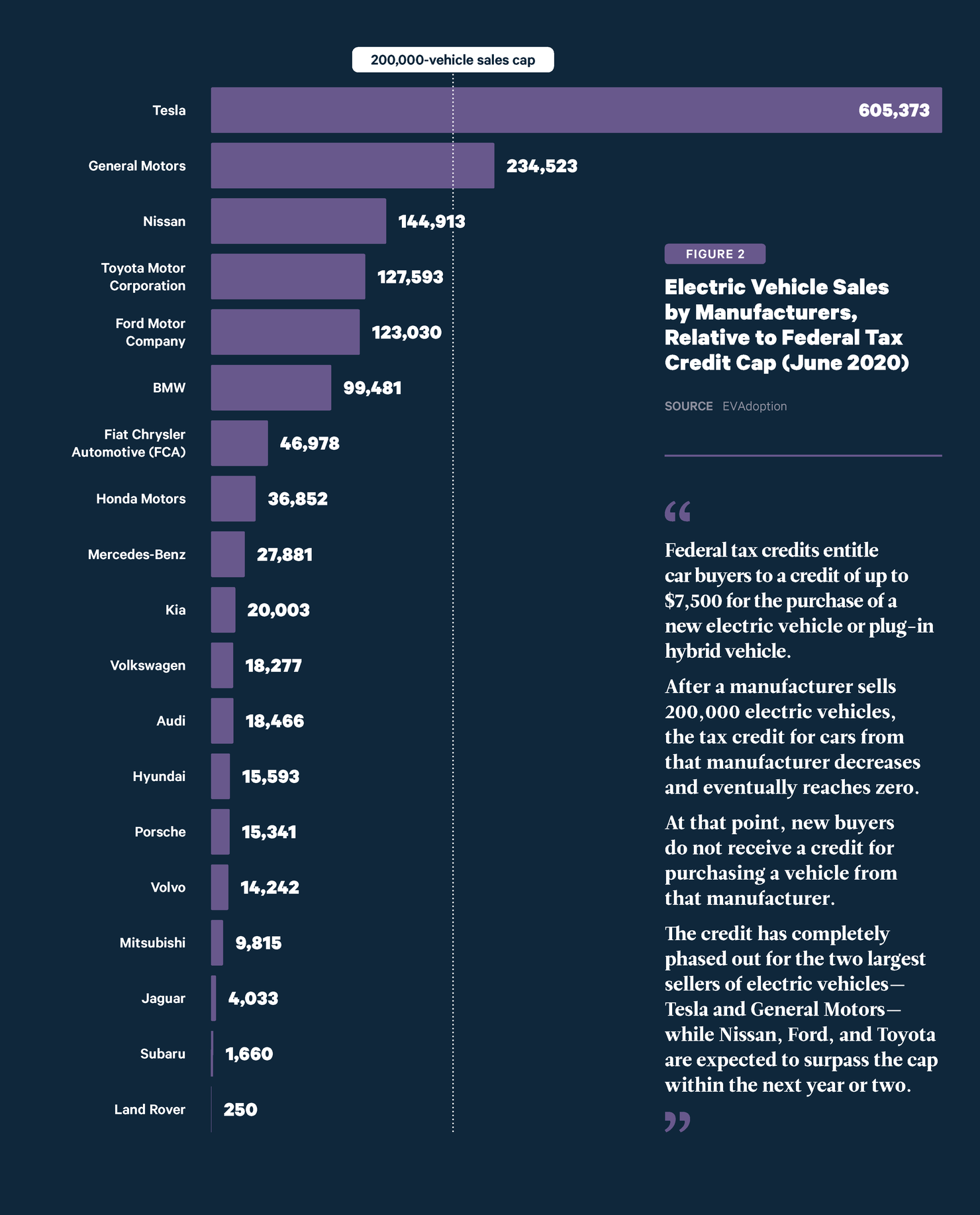

Federal tax credits entitle car buyers to a credit of up to $7,500 for the purchase of a new EV or plug-in hybrid vehicle. After a manufacturer sells 200,000 EVs, the tax credit for cars from that manufacturer decreases and eventually reaches zero. At that point, new buyers do not receive a credit for purchasing a vehicle from that manufacturer. The credit has completely phased out for the two largest sellers of EVs—Tesla and General Motors—while Nissan, Ford, and Toyota are expected to surpass the cap within the next year or two (Figure 2).

Twelve states have ZEV programs: California, Colorado, Connecticut, Maine, Maryland, Massachusetts, New Jersey, New York, Oregon, Rhode Island, Vermont, and Washington. Because about 30 percent of new car sales in the United States occur in these states, these ZEV programs stand to significantly influence emissions from the US transportation sector.

On September 23, 2020, California announced an executive order that would ban the sale of new internal combustion engine vehicles in California after 2035, which effectively amounts to a 100 percent ZEV requirement. In October 2020, Senator Jeff Merkley (D-OR) and Representative Mike Levin (D-CA) introduced similar federal legislation.

Greenhouse Gas Emissions Standards for Airplanes

The Basics

Aircraft represent the third-largest source (9 percent) of transportation-sector GHG emissions (Figure 1). The primary source of energy for flight is jet fuel, which is derived from crude oil. GHG standards, similar to those implemented for other vehicles, are the primary policy tool for reducing aircraft emissions. These standards reduce emissions by requiring certain new airplanes to reduce the amount of fuel consumed when traveling a set distance.

Benefits

- GHG standards can reduce aircraft emissions if set to a sufficient level.

- These standards may enable aircraft manufactured in the United States to remain competitive in international markets, if the policy aligns with international standards set by the International Civil Aviation Organization.

- GHG standards for aircraft could encourage innovation in a difficult-to-decarbonize part of the transportation sector.

Challenges

- Similar to fuel economy standards for passenger vehicles, the rebound effect and delayed fleet turnover make this option an inefficient method of reducing emissions.

Key Considerations

- How high to set the standard.

- How to measure compliance.

- Policymakers must consider current international standards and whether to align US standards with international policy or make US standards more or less stringent. While following international standards may be beneficial and affordable, some environmental groups and other critics have considered this option unambitious and insufficient to motivate significant GHG reductions.

Past, Current, and Proposed Greenhouse Gas Standards for Airplanes

In 2020, EPA finalized GHG emissions standards that apply to certain new commercial airplanes, including all large passenger jets. This final rule applies to manufacturers of new civil aircraft and requires certain new airplanes to meet a “fuel efficiency metric” based on the airplane’s certified weight. These standards match the international airplane carbon dioxide standards adopted by the International Civil Aviation Organization in 2017.

Renewable Fuel Standards and Low-Carbon Fuel Standards

The Basics

The Renewable Fuel Standard (RFS) and Low-Carbon Fuel Standard (LCFS) are performance standards that require regulated emissions sources (such as fuel refiners, in the case of an RFS) to achieve a specified GHG emissions–related target. An RFS requires transportation fuel to contain a minimum volume of renewable fuels, such as biofuels. An LCFS limits a fuel producer’s carbon emissions per unit of fuel produced.

Benefits

- Performance standards tend to be more popular among consumers than other emissions reduction policies, in part because their costs are less obvious than explicit carbon price policies (e.g., a carbon tax).

- Tradable performance standards—which add a credit-trading aspect to performance standards—can be cost-effective, particularly for products with low elasticity of demand (e.g., vehicle miles traveled).

Challenges

- Although they can be cost-effective, tradable performance standards generally are less cost-effective than a carbon tax, because standards target only a subset of actions that can reduce GHG emissions.

- Both the RFS and LCFS act as subsidies for production that can create GHG emissions. The RFS subsidizes ethanol production, the primary fuel used for compliance, which can generate net positive GHG emissions, depending on how it’s produced. The LCFS subsidizes natural gas production, which creates GHG emissions as a byproduct when burned. Although ethanol and natural gas contain less carbon than the fuels they displace, these fuels can still generate GHG emissions.

Key Considerations

- To ensure that RFSs reduce emissions, each renewable fuel must emit less than the petroleum that it replaces. This rule historically has been a controversial piece of the federal RFS program, because it requires estimating the GHG emissions of the renewable fuel itself, which poses empirical challenges due to the difficulty of tracking the origin of the fuel.

- For LCFSs, whether to allow regulated entities to earn, buy, and sell regulatory credits. If an LCFS allows for these trades, policymakers should consider areas of potential overlap with other regulations that allow trading.

Past, Current, and Proposed Renewable and Low-Carbon Fuel Standards

As part of the Energy Independence and Security Act of 2007, the RFS requires transportation fuel sold in the United States to contain a minimum amount of renewable fuels. This minimum amount increases each year and is scheduled to be 36 billion gallons in 2022. The RFS regulates refiners and refined-petroleum product importers. It also includes a tradable credit system.

Although California implemented an LCFS in 2011, no federal LCFS is in place. A group of biofuel companies, agriculture representatives, and car companies have urged the Biden administration to adopt a nationwide “clean fuel standard,” which would require reductions in the amount of GHG emissions emitted through the production, transport, and combustion of fuels.

This article is available as a published RFF explainer titled “Federal Climate Policy 104: The Transportation Sector.”