The complexity of the industrial sector means that we won’t find any straightforward answers and approaches to decarbonization. A combination of pathways to reduced emissions likely is necessary—which could include incentivizing low-carbon processes, carbon capture, energy efficiency, waste reduction, decarbonizing the grid, and technological innovation. Policymakers can apply these pathways by prioritizing their approach based on the subsector, or the process, or the fuel that’s involved.

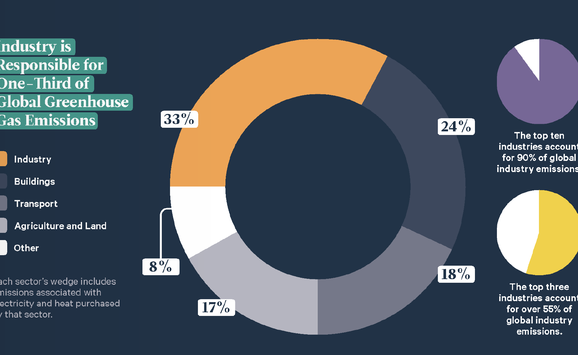

Reducing industrial emissions of greenhouse gases (GHGs)—primarily carbon dioxide (CO₂), but also nitrous oxide and methane—has received little policy attention compared to the power and transportation sectors, in spite of industry’s large and growing carbon footprint. In 2019, the industrial sector produced 29.6 percent of all GHG emissions in the United States. The majority of industrial emissions (78 percent) comes directly from industrial processes, heating, and other uses, while about 22 percent are emissions that arise indirectly from the use of electricity within the sector. The industrial sector includes a diverse set of activities, such as manufacturing goods and producing materials like steel and cement.

The industrial sector encompasses a diverse set of products and processes with widely varying levels of emissions. Several mitigation pathways are possible—and likely necessary—to reduce industrial emissions:

- Incentivizing a shift away from high-carbon energy sources and high-carbon manufacturing processes toward lower-carbon energy sources (e.g., low-methane emissions natural gas, decarbonized hydrogen, and biogas) and lower-carbon processes (e.g., electrification of production processes and heat sources).

- Encouraging industrial sources to capture their CO₂ emissions.

- Reducing energy use by increasing the energy efficiency of production processes and heat systems.

- Cutting material use and planning for the “circular economy” through product designs and manufacturing standards that reduce waste and one-time use.

- Decarbonizing the grid.

- Accelerating technological development that reduces costs or increases the efficacy of the other five pathways.

Policies can target one or more of these pathways—and some policies can operate on all six at once. For example, a carbon price applied to all industrial sources of CO₂ would encourage factory managers and company owners to find the cheapest ways of reducing emissions and avoiding carbon fees, thereby indirectly stimulating innovation. However, sufficiently high carbon prices to decarbonize the industrial sector may be politically infeasible. Also, most emissions policies operating directly on the industrial sector cannot sufficiently incentivize innovation, so policies promoting research, development, and demonstration (RD&D) still would be needed.

In addition to considering the mitigation pathways above, policymakers can think of industrial decarbonization in a few different ways:

- By subsector or product: For instance, a piece of legislation may aim to reduce emissions from refineries or cement manufacturing, specifically.

- By process: Decarbonizing a process that’s common to multiple industrial subsectors; for instance, a standard to improve boiler or motor efficiency, or a limit on emissions from blast furnace steel production.

- By fuel: For instance, regulations may restrict the use of coal, or tax credits could encourage the use of certain low-carbon fuels.

A variety of policy approaches to reduce industrial emissions along one or more of these pathways exist. While these types of policy options may be less efficient than an economy-wide carbon price, these alternatives nonetheless may be more politically feasible. This article examines several of the options.

The example of hydrogen is used throughout this article as a major opportunity for industrial decarbonization. Other opportunities exist, including energy efficiency; electrification; fuel switching from coal to gas; carbon capture, utilization, and storage (CCUS); and various industry-specific technologies. The recent interest in hydrogen for long-term decarbonization across industrial sectors has distinguished it as a significant area of opportunity, and thus is our focus in this article.

Tax Credits

The Basics

Tax credits enable emitters to pay lower taxes in exchange for reducing their emissions. Tax credits are flexible: they can be designed to reduce CO₂ emissions broadly, or they can be more targeted. Under a broad tax credit policy, industrial emitters can decide how to reduce their emissions. Alternatively, a credit program can favor specific technologies; for example, investment and production tax credits are available for solar power, wind power, and CCUS. Economists typically consider the designation of technological “winners” as economically inefficient, but tax credits that target certain technologies can create incentives for innovation in the private sector that ultimately will reduce the costs of the favored technologies.

Benefits

- Tax credits—a subsidy by another name—is far more popular than pollution taxes among most policymakers and regulated entities.

- Tax credits are a familiar federal policy with a decent track record (e.g., in stimulating renewables).

Challenges

- Tax credits often are expensive.

- Tax credits tend to be narrowly drawn, potentially excluding promising options by “picking winners” when the credits target certain technologies.

- Tax credits may not be sufficient on their own. For example, even with a tax credit, low-carbon hydrogen production may not be economical.

- The most efficient tax credit would be based on actual reductions in CO₂ emissions, rather than the production volume or amount of money invested in renewables.

Key Considerations

- Who receives the credit and what they must do to receive it. For example, with decarbonized hydrogen, producers could receive a credit if they reduce the emissions associated with hydrogen production; or users who purchase decarbonized hydrogen could get a credit for replacing high-carbon hydrogen, fuels, and industrial feedstocks with lower-carbon alternatives; or both producers and users could receive a credit through two different credit systems.

- Coordination with other tax credits to avoid double-counting (such as with the 45Q program).

- The level of the credit—the amount of money awarded for the desired action—can be established in two basic ways: based on the social cost of carbon or based on the value that’s necessary to motivate the desired action.

- Who is eligible to receive the credit.

- Determining timelines, such as when production or investment must begin and when credits are available.

- Requirements for monitoring, reporting, and verification.

Past, Current, and Proposed Tax Credits

In the industrial sector, the 45Q tax credit for CCUS has led at least one industrial entity so far to develop a proposal to replace the production and use of gray hydrogen with blue hydrogen.

Energy Efficiency Standards

The Basics

Improving energy efficiency is a proxy, albeit imperfect for reducing CO₂ emissions in the industrial sector. Energy-efficient technologies have promise for reducing the costs and environmental damages associated with energy use, but these technologies are not being leveraged to their full economic benefit by businesses or consumers. Policies that encourage the adoption of energy-efficient technologies can both benefit the industrial sector and reduce emissions. Two types of energy efficiency standards are commonly discussed:

- Prescriptive standards (also known as technology standards) require a particular energy-saving technology or process to be installed or used. Historically in the environmental field, prescriptive standards have been applied most often for reducing pollutants—but they could be applied to the industrial sector, as well.

- Performance standards limit the emissions or energy consumption per unit of product (e.g., amount of GHGs emitted per ton of cement manufactured). Performance standards do not require a specific technology or process.

Benefits

- Reduced energy use.

- Lower GHG emissions.

- Lower conventional pollutant emissions.

- Reduced energy use often reduces operating costs, which can offset some or all of the higher capital costs.

- Energy efficiency standards generally are transparent, which simplifies enforcement.

Challenges

- Increased capital costs of the products or processes covered by the policy.

- Potential reductions in performance.

- Prescriptive standards do not allow much flexibility for producers.

- Prescriptive standards can lock in particular technologies, which can forestall technological innovations.

Key Considerations

- Policies should be designed to address the specific causes of the energy efficiency gap. Root causes can include the market power of firms, limited information about new technologies, unobserved costs, not understanding a firm’s own energy operating costs, and an inability to capture the full benefits of RD&D.

Past, Current, and Proposed Energy Efficiency Standards

Energy efficiency standards are in place for appliances, which are relevant to the industrial sector and the buildings sector. The National Appliance Energy Conservation Act of 1987 established minimum efficiency standards for many common household appliances. The Energy Independence and Security Act of 2007 updated or enacted standards for 13 products.

Starting in the late 1990s, the US Environmental Protection Agency established Energy Star and other industry-oriented, nonregulatory, and voluntary programs that certify products (e.g., cement) which help reduce GHG emissions by reducing the amount of energy consumed per unit product. Typically, products with such certification sell for a higher price per ton and can be eligible for green procurement programs.

Tradable Performance Standard

The Basics

A performance standard is a policy that sets a benchmark that firms must meet, without specifying how the benchmark should be achieved. A tradable performance standard (TPS)—sometimes referred to as a “clean energy standard” for industry—is a flexible mechanism that encourages firms to use less carbon-intensive materials and employ production techniques that lead to lower emissions.

The “tradable” aspect of a TPS refers to the ability of firms to buy and sell credits with one another. Enabling tradable credits can improve overall cost-effectiveness and encourage innovation that in turn leads to lower emissions, as companies can make money from selling excess credits.

In principle, a TPS can be set for each industrial category or subcategory, requiring firms to meet emissions or other benchmarks based on the quantity or dollar value of product sold. Depending on the design of the system, a TPS for industry might allow trading within each sector and across sectors. Certain elements of existing cap-and-trade programs are carried over to TPSs. A TPS can create incentives for firms to reduce emissions, approximately similar to a cap-and-trade program that allocates emissions allowances in proportion to a facility’s output. Examples include California’s economy-wide cap-and-trade program and the European Union Emissions Trading System.

Benefits

- A TPS is more flexible, compared to an energy efficiency standard.

- A TPS is generally more cost-effective, compared to an energy efficiency standard.

- A TPS rewards innovative firms for emissions reductions: reducing emissions generates compliance credits that can be sold to firms whose performance would otherwise fall short of the standard.

- A TPS comes with relatively lower costs overall, given that a TPS is less likely than a carbon price to harm industrial sector employment or cause emissions leakage. (Leakage happens when a regulation in one jurisdiction raises costs enough to shift economic activity and corollary emissions from a regulated area to an unregulated area.)

Challenges

- Product price increases are small with a TPS, compared to a carbon price, which provides less incentive for consumers to shift away from emissions-intensive products and toward more environmentally friendly products.

- Applying multiple industry- or product-specific standards can increase production costs.

Key Considerations

- Recent research reveals large differences between the highest and lowest energy-intensive production facilities in various industrial subsectors, including cement, bulk chemicals, and iron and steel. Thus, potentially large efficiency gains may be attainable, and a TPS is a plausible mechanism for achieving these gains.

- How to manage the diversity of products and industries within the sector. The complexity can pose a challenge, particularly for subsectors with a wide variety of products, whereas establishing benchmarks for products that are relatively homogeneous—such as some cement products, basic steel, and bulk chemicals—may be less challenging. Strategies to allocate emissions allowances in cap-and-trade programs can be adapted to define TPSs for heterogeneous subsectors.

Past, Current, and Proposed Tradable Performance Standards

To date, application of TPSs to industry has been limited. A proposal by Representative Sean Casten (D-IL) would cover both the industrial sector and the electricity sector. The proposal would apply a clean energy standard to electricity generators and industrial thermal energy generators, requiring that energy producers meet certain emissions-intensity benchmarks for the energy they generate.

Another example of a TPS that spans sectors is California’s Low Carbon Fuel Standard. This policy regulates the carbon intensity of the full life cycle of transportation fuels, incentivizing carbon reductions in transportation, electricity, and the agricultural activities that fuel transportation.

China also has announced its intention to establish a TPS for the nation’s power sector and various industrial sectors.

Research, Development, and Demonstration

The Basics

Government funding for carbon-reducing technologies can help technologies mature, become less costly, and reach commercial scale. Research, development, and demonstration (RD&D) is particularly important for reducing industrial emissions, as some current industrial production processes offer few opportunities to reduce emissions.

Many policy options are available to help fund innovation. These policies can be classified as “supply-push” and “dem-and-pull” policies. Supply-push policies are traditional ways of issuing government-funded grants, such as ManufacturingUSA, or federal laboratories. Demand-pull policies aim to shape or stimulate the market for technologies by creating demand or reducing uncertainty in prices. Demand-pull policies include government green procurement policies; contracting guidance; market-creation mandates; and prizes, challenges, or milestone programs that better target RD&D.

Benefits

- RD&D funding can lead to the commercial viability of advanced energy technologies and emissions-reducing technologies.

- RD&D can enable the discovery of new technologies.

- Related technological advances and discoveries could both reduce the industrial sector’s carbon footprint and make emissions reductions less costly, as more technologies compete to provide reduced-carbon (or carbon-free) products.

Challenges

- The government must pay to fund RD&D, which drains government revenues.

- RD&D spending comes with inherent risks, as the efforts do not guarantee technological advances. That said, policies can be designed to minimize such risks.

Key Considerations

- Ensure that funds are spent wisely.

- Unclear which technologies and areas of development warrant the most investment, as future advances cannot be predicted.

- Unclear which policies will be most beneficial.

- Unclear which sectors will benefit most from RD&D investments.

Past, Current, and Proposed RD&D Funding

The Energy Act of 2020, which passed as part of the omnibus spending bill in December 2020, is an example of using federal RD&D spending to promote industrial decarbonization. This legislation increases funding for CCUS, direct air capture, advanced nuclear reactors, and energy storage technologies—all of which can help to decarbonize industry.

The US government supports a range of other initiatives to boost RD&D. For instance, H2@Scale is an RD&D funding opportunity for cooperative agreements between the private sector and the US Department of Energy’s National Laboratories to develop and implement new technologies.

This article is available as a published RFF explainer titled “Federal Climate Policy 105: The Industrial Sector.”